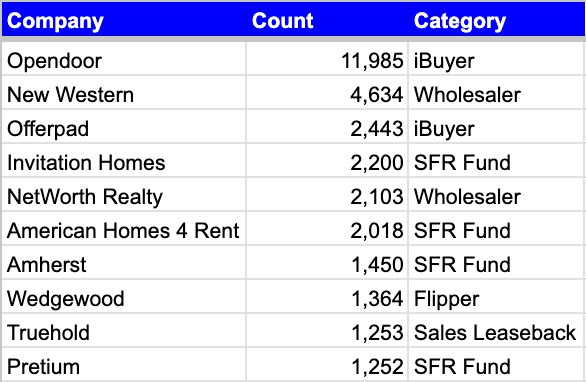

The Top 10 Largest Homebuyers In 2024

Transactional Players Dominate as Institutional SFR Fund Activity Remains Muted in Post-Pandemic Market

Executive Summary

We looked at the top 10 acquirers of single-family properties in 2024 to see which firms purchased the most properties.

Institutional activity remains muted, with the top firms maintaining acquisition levels similar to those seen in 2023.

A diverse range of players make up the top 10 — including sales leaseback companies, SFR funds, iBuyers, and flippers. Notably, 4 of the top 5 largest buyers are not traditional SFR funds.

At the end of the article, transaction-level details including purchase date, price, property address, and property characteristics of the buyers are available.

Introduction

Following the substantial surge in acquisitions during 2021, institutional investors significantly curtailed their purchase activity in 2023. While 5,000+ acquisitions per year was the threshold to make it into the top 10 largest SFR purchasers in 2021, it now takes about 80% fewer properties to secure a spot on the top 10 list in 2024.

Some funds remained active despite market headwinds, continuing to acquire between several dozen and a few hundred properties per month. Private SFR funds like Amherst and Pretium made the top 10, along with public SFR fund Invitation Homes, all of which have recently been profiled on the SFR Analytics blog.

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the single-family home investing market. To generate this analysis, we’ve:

Identified and reconciled the entities that institutions have purchased homes under.

Tagged and filtered transaction types to remove “entity shuffling” where a property is moved between different LLCs controlled by the same entity.

Note: our analysis may contain omissions — both Networth and New Western purchase through dozens of different LLCs, some of which we may have missed in our tracking. Further, in some metros they wholesale instead of double closing so there’s no public record of the transaction. Build to rent acquisitions may also not show up — especially ones where the community has not been built yet. For example, the Second Avenue acquisition of Pacific Oak is excluded from our analysis because the transaction details have not yet appeared in publicly available records.

Analysis & Results

Top Buyers

Commentary

The leading buyers of 2024 are primarily companies that hold properties only temporarily. Opendoor and Offerpad typically buy and resell within 90 days, limiting market exposure, while New Western and NetWorth effectively double close all transactions, meaning they don't actually hold onto the properties.

Invitation Homes, American Homes 4 Rent, Amherst, and Pretium are 4 of the 6 largest SFR funds (Tricon and First Key are the other two) who are still modestly acquiring.

Truehold is a sales leaseback company primarily focused in the midwest and has been rapidly growing recently.

Finally, Wedgewood, a home flipper based in Southern California, makes the top 10 list for the second consecutive year. Their operations are remarkable, flipping homes in dozens of states.

Compared to the acquisition frenzy during the pandemic, the current volume of homes being purchased by institutional funds is negligible, particularly when considering net acquisitions (for context, Invitation Homes sold 1,575 homes last year).

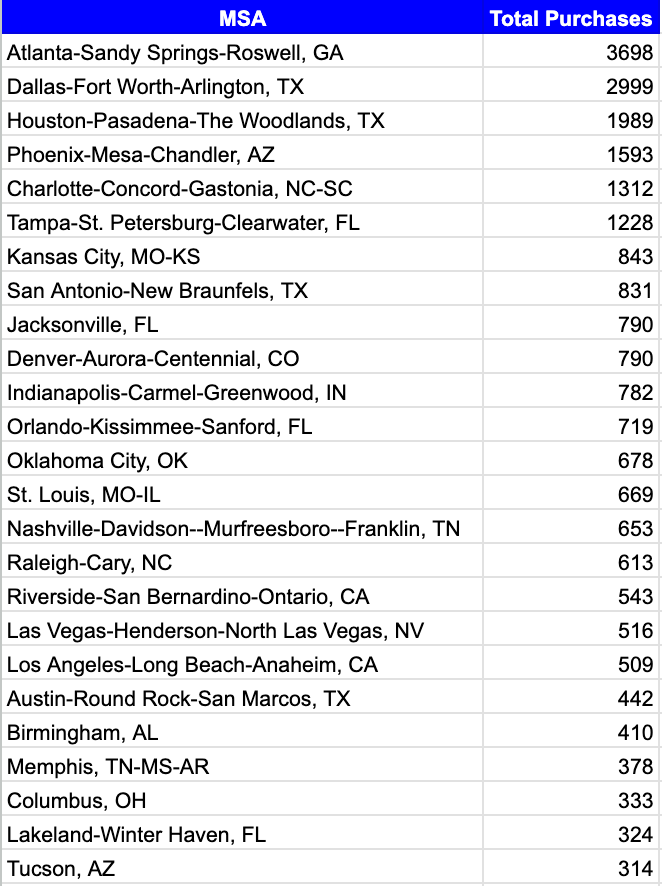

Purchases by Metro

Atlanta was the largest metro by purchase volume and had every buyer present except Truehold. Florida and Texas each had 4 metros represented in the data, with Dallas standing out as a particularly active market where every buyer in our top 10 has a presence.

The strategic differences between these buyers are substantial, revealing distinct approaches to the single-family market. Wedgewood's top two markets are the Inland Empire (Riverside) and Los Angeles, neither of which Truehold operates in. Truehold’s top markets are St. Louis and OKC, in neither of which Wedgewood operates. These contrasting business models naturally lead these companies to target fundamentally different property types and locations. While the SFR funds tend to buy similar properties, the strategies of the rest of the top 10 can vary widely.

Acquisition Count by Top Buyers

As a reminder, these figures only count resale properties that are coded as single-family residences by the county assessor where the property is based. There is significant entity detection and matching work involved; while we believe these numbers are mostly accurate, there may be some discrepancies compared to actual totals.

One company that may be more meaningfully undercounted is New Western. New Western uses different LLCs for each metro area and doesn’t follow a standardized approach, which makes aggregation more difficult. Additionally, New Western doesn’t always double close its transactions; occasionally, New Western will instead assign contracts which don’t show up in county records.

Transaction-Level Details

While aggregate statistics tell part of the story, transaction-level details provide more nuanced information about the activity of institutional buyers. Below, we’ve included all transactions from institutional buyers in 2024, including details like property address and characteristics (bed, bath, square feet, etc).

Note: for complete transaction-level data and detailed analysis, sign up below to access the full report and database. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.