Invitation Homes Breakdown

Portfolio holdings, gross rental yields, purchase and sale activity, and more for INVH.

Executive Summary

Invitation Homes (INVH) has built a portfolio of 84,000+ single-family rental properties across the country, with over half of the portfolio located in Florida, Georgia, and California. While many SFR funds operate only within the Sunbelt, INVH’s holdings extend to the Midwest and Northwest.

Compared to other SFR funds, the bulk of INVH’s portfolio has been purchased earlier and held for longer, partly driving lower median entry price compared to other funds.

Gross yields remain healthy across metros, with most at a median value in the 12% to 15% range. Rent growth has slowed significantly across all metros compared to the high rent growth period of 2021.

Detailed information breaking down gross yields by metro, rent growth by metro, and real-time estimates of new lease rent growth are available at the end of the article.

Introduction

Invitation Homes is the largest public SFR REIT with an existing portfolio of 84,000+ homes. It was founded in 2012 and scaled quickly, buying ~40,000 homes in 2012-2013 alone during the recovery period following the 2008 global financial crisis. INVH is the largest SFR operator by property count and has the largest market share by count of properties in over a dozen metros where there are at least 500 homes owned by an SFR fund.

Q3 2023 saw Invitation Homes acquire more homes than in any other quarter since it became a publicly traded company in early 2017. Like all SFR funds, many deals are no longer penciling with higher interest rates, but buying a 1,900 home portfolio from Starwood was enough to make it the fund’s most active quarter in over five years.

The company will report earnings on February 21st. A variety of factors make it an interesting time for both the company and the larger SFR industry: year-over-year rent growth slowing significantly, Blackstone’s acquisition of Tricon to fold into its existing SFR portfolio from its 2021 acquisition of Home Partners of America (to read more about Blackstone’s SFR exposure, check out our recent breakdown), and an expectation of multiple rate cuts over the next 12 months.

Additionally, INVH is expanding its strategy, recently taking on the management of properties for Tiber and Roofstock.

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and rental listing data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that Invitation Homes has purchased homes under

Matched rental listing data to the underlying ownership information that links an entity to Invitation Homes

Aggregated additional sources of data, like school ratings, to provide additional context about the neighborhoods where properties are held

Note: A more detailed breakdown of data and methodology used is available at the bottom of the post.

Analysis & Results

Geographic Distribution

Invitation Homes has built an 84,000+ home portfolio spanning the county, with properties in the Northwest, Southwest, Midwest, and Southeast.

Invitation Homes’ largest states by ownership are Florida and Georgia, followed by California and Arizona. This state tilt towards Florida, Georgia, and California is similar to the other public SFR REITs. For comparison, the top three states that American Homes 4 Rent owns properties in are Texas, Florida, and North Carolina; for Tricon, the top three states are Georgia, Texas, and Florida.

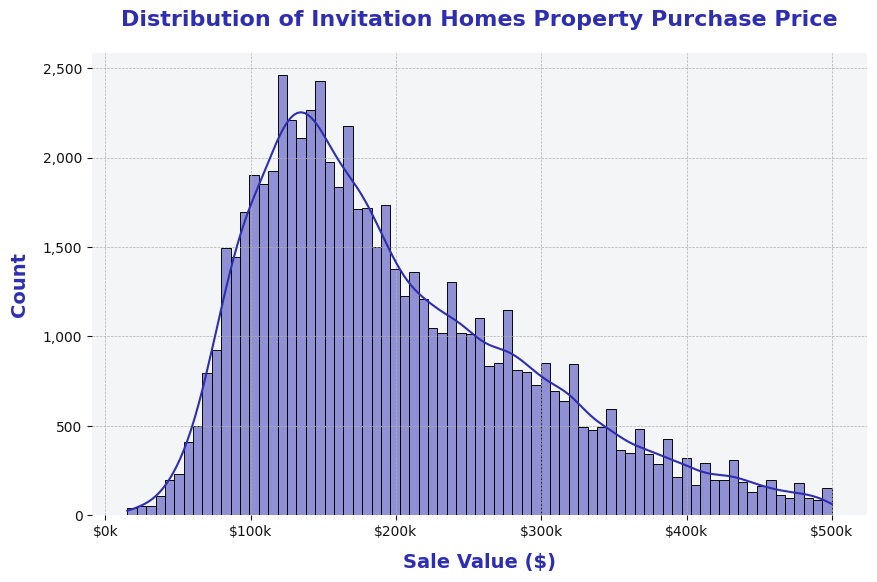

Purchase Price Distribution

Compared to workforce housing providers like SFR3 (profiled in a recent SFR post) and VineBrook Homes (profiled a few weeks ago), Invitation Homes buys nicer homes in more desirable areas, targeting higher income tenants including families. Because many of the homes held by Invitation Homes were purchased years ago when price levels were lower, the median purchase price may look lower than expected for the quality of home. The median square footage of homes owned by Invitation Homes is 1,778 square feet, compared to 1,200 square feet for SFR3 and 1,180 for VineBrook, both of which focus on affordability.

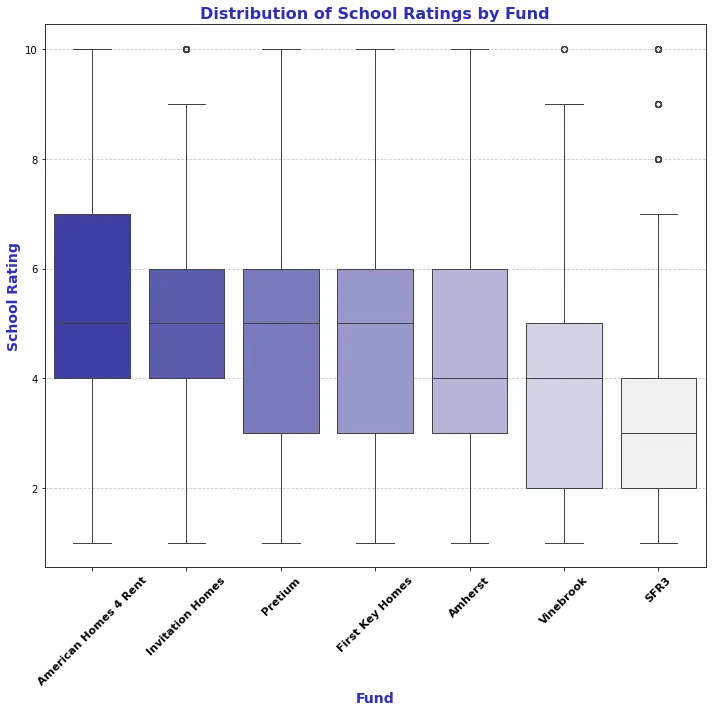

School Ratings

The distribution of ratings for schools near homes owned by Invitation Homes is similar when compared to American Homes 4 Rent. Ratings are notably higher than those for workforce housing providers like SFR3 and VineBrook.

Market-Level Gross Yields and Rent Growth

To find new rental tenants, Invitation Homes has had to engage in record-levels of price cuts on listings, contributing to much lower year-over-year rent growth.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.