Executive Summary

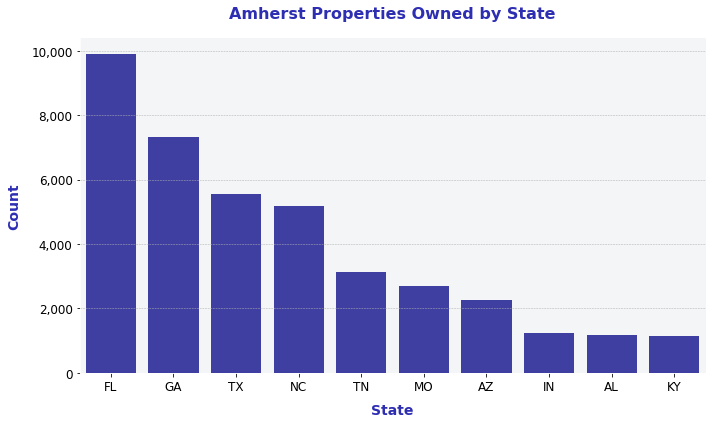

Amherst has built a portfolio of 45,000+ single-family rental properties across the country, with almost half of the portfolio located in Florida, Georgia, and Texas. While many SFR funds operate only within the Sunbelt, Amherst’s holdings extend to the Midwest.

Amherst has steadily grown its portfolio since beginning operations in 2012 with the bulk of the existing portfolio acquired between 2019 and 2022 when the company bought more than 5,000 properties per year. During late 2021 and early 2022, the fund sold off a few hundreds properties in select regions.

Gross yields within the portfolio remain healthy across metros, with most at a median value in the 8% to 14% range. Detailed information breaking down gross yields by metro are available at the end of the article.

Introduction

Established in 2012, Amherst Residential is a leading SFR fund with a 45,000+ home portfolio spanning the Sunbelt and Midwest, over $18 billion in assets under management, and a presence in 32 markets. Amherst has grown steadily, purchasing up to 2,000 properties a year from 2012 to 2018. From 2019-2022, the company accelerated purchase volume, buying over 6,000 properties per year.

A 2019 article from Fortune, based on an interview with Amherst CEO Sean Dobson, sheds light into the strategy of the fund, describing the target demographic as “couples in their early forties with one or two kids and household incomes around $60,000 … we’re catering to a whole new class of Americans—the former buyers who are now either forced renters or renters by choice.” Properties matching the needs and location of those buyers tend to be “affordable suburbs in the solid middle of the U.S. housing sector.”

Alongside Amherst Residential, Amherst also operates Main Street Renewal, a vertically-integrated property management company that services the single-family residents living in properties owned by Amherst Residential platform.

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and rental listing data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that Amherst has purchased homes under

Matched rental listing data to the underlying ownership information that links an entity to Amherst

Aggregated additional sources of data, like school ratings, to provide additional context about the neighborhoods where properties are held

Note: A more detailed breakdown of data and methodology used is available at the bottom of the post.

Analysis & Results

Geographic Distribution

Amherst has built a 45,000+ home portfolio spanning the county, with properties in the Southwest, Midwest, and Southeast.

Amherst’s largest states by ownership are Florida and Georgia, followed by Texas and North Carolina. This state tilt towards Florida and Georgia is similar to public SFR REITs. For comparison, the top three states that American Homes 4 Rent owns properties in are Texas, Florida, and North Carolina; for Tricon, the top three states are Georgia, Texas, and Florida.

Purchase Price Distribution

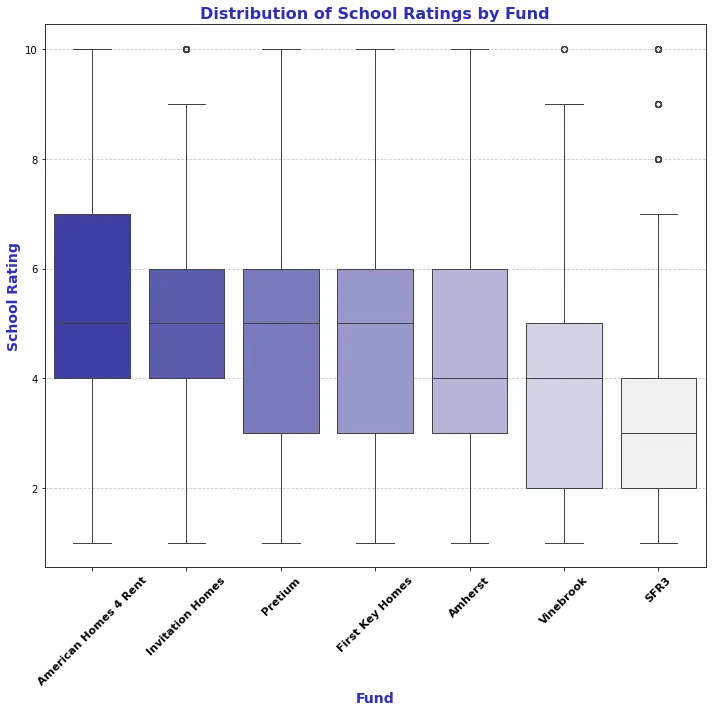

Compared to workforce housing providers like SFR3 (profiled in a recent SFR post) and VineBrook Homes (profiled a few weeks ago), Amherst generally buys nicer homes in more desirable areas with a median acquisition price of $220k, targeting higher income tenants including families.

The median square footage of homes owned by Amherst is 1,516 square feet, compared to 1,200 square feet for SFR3 and 1,180 for VineBrook, both of which focus on affordability.

School Ratings

The distribution of ratings for schools near homes owned by Amherst is similar when compared to other private SFR funds like Pretium and FirstKey Homes. Ratings are notably higher than those for workforce housing providers like SFR3 and VineBrook.

Property Sales and Market-Level Gross Yields

Amherst has steadily grown its portfolio since beginning operations in 2012, but during late 2021 and early 2022 the fund sold off a few hundreds properties in select regions.

While Amherst operates throughout the Sunbelt and Midwest, gross yields within the portfolio vary significantly by geography.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.