The Pretium Playbook Expands: SFR Giant Targets Section 8 Housing

A deep dive into the portfolio strategy of America's largest private SFR owner.

Introduction

Pretium Partners, one of the largest institutional single-family rental (SFR) owners in the United States with a portfolio approaching 97,000 homes, is making headlines with its latest strategic move. According to Bloomberg, the $60 billion investment manager is raising its first fund dedicated to acquiring single-family homes for affordable rentals through the federal government's Section 8 Housing Choice Voucher program. This initiative signals a significant strategic shift at a time when elevated borrowing costs have altered the SFR investment landscape.

Despite its massive footprint, Pretium maintains a relatively low profile compared to publicly traded SFR REITs like Invitation Homes and American Homes 4 Rent. This expansion into the affordable housing segment represents both an adaptation to current market conditions and a potential new growth vector for the firm. For readers seeking background on Section 8 housing dynamics and their implications for SFR investors, our previous analysis provides comprehensive context.

Our analysis dives deep into Pretium's existing portfolio using proprietary data to understand their investment thesis, geographic strategy, and financial performance—providing critical context for evaluating this new direction. We also look at how their new affordable housing strategy may differ significantly from their current portfolio.

Geographic Strategy: Focused on the Sunbelt

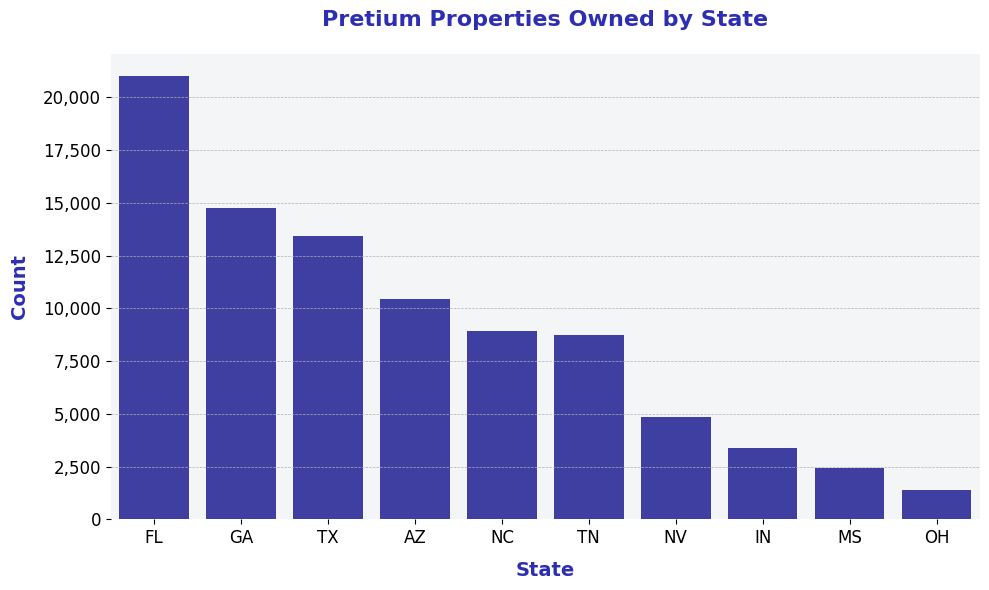

Pretium's geographic distribution reveals a clear focus on high-growth Sunbelt markets with favorable landlord-tenant laws and strong economic fundamentals:

Top States in Pretium's Portfolio:

Florida (20,000+ homes)

Georgia (12,750+ homes)

Texas (12,500+ homes)

Arizona (9,500+ homes)

Tennessee (8,000+ homes)

This Sunbelt concentration aligns with demographic trends showing population migration to these regions and relatively affordable housing compared to coastal markets. Notably, Pretium appears to largely avoid high-regulation states with more tenant-friendly laws.

Growth Timeline: Aggressive Pandemic Expansion

One of the most revealing aspects of our analysis is Pretium's acquisition timeline. Their portfolio growth shows clear strategic timing:

Key Acquisition Phases:

2012-2015: Initial portfolio building phase following the housing crisis

2016-2019: Steady acquisition pace, averaging 6,000-8,000 homes annually

2021-2022: Dramatic acceleration, with over 16,000 homes acquired in 2021 alone

2023-Present: Moderation in acquisition pace amid changing market conditions

This acquisition pattern demonstrates Pretium's ability to capitalize on market opportunities, particularly during the pandemic housing boom when their capital advantages allowed them to acquire properties at scale while individual buyers faced increasing affordability challenges.