Profiling Blackstone's SFR Exposure

The first look at the combined assets of HPA and Tricon following Blackstone's $3.5B acquisition of TCN.

Executive Summary

In 2021, Blackstone acquired Home Partners of America for $6 billion, picking up its portfolio of 17,000+ single-family homes.

On Friday, Blackstone announced its intention to acquire Tricon Residential (TCN), a publicly listed SFR REIT, for $3.5b and incorporate its 38,000+ home portfolio.

Blackstone started Invitation Homes in 2012, acquiring large numbers of foreclosed homes when the housing market was bottoming out following the 2007-2008 recession. Invitation Homes grew rapidly, becoming the largest owner of single-family homes in the US, holding more than 48,000 homes by 2017. Invitation Homes went public in 2017, and Blackstone divested its stake in the company in 2019 over two separate transactions.

By acquiring Tricon, Blackstone tilts its exposure towards more conventional SFR investment properties, increasing its holdings of newer, smaller single-family rentals in core SFR markets across the Sunbelt. This expands their footprint in the single-family residential business to a combined portfolio of over 55,000 homes.

Introduction

Blackstone started Invitation Homes in 2012, acquiring large numbers of foreclosed homes when the housing market was bottoming out following the 2007-2008 recession. Invitation Homes grew rapidly, becoming the largest owner of single-family homes in the US, holding more than 48,000 by 2017. Invitation Homes went public in 2017, and Blackstone divested its stake in the company in 2019 over two separate transactions.

In 2021, Blackstone acquired Home Partners of America (HPA) for $6 billion, picking up its portfolio of 17,000+ single-family homes. HPA is focused on a rent-to-own model that is designed to provide a pathway to homeownership for individuals who may not currently qualify for a traditional mortgage due to financial constraints, credit issues, or other reasons.

As announced on January 19th, Blackstone will acquire all outstanding shares of Tricon (TCN) for $11.25 per share in cash. Valued at $3.5 billion, the price represents a 30.35% premium over Tricon's last closing stock price. Tricon has built a portfolio of 38,000+ single-family rental properties across the US, with almost half of the portfolio held in Georgia, Texas, and Florida. To read more about Tricon’s portfolio, see this breakdown we released on the day of the acquisition announcement: https://sfranalytics.substack.com/p/tricon-residential-tcn-acquired-by

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and rental listing data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that Home Partners of American and Tricon have purchased homes under

Matched rental listing data to the underlying ownership information that links an entity to Home Partners of American and Tricon

Aggregated additional sources of data, like school ratings, to provide additional context about the neighborhoods where properties are held

Note: A more detailed breakdown of data and methodology used is available at the bottom of the post.

Analysis & Results

Geographic Distribution

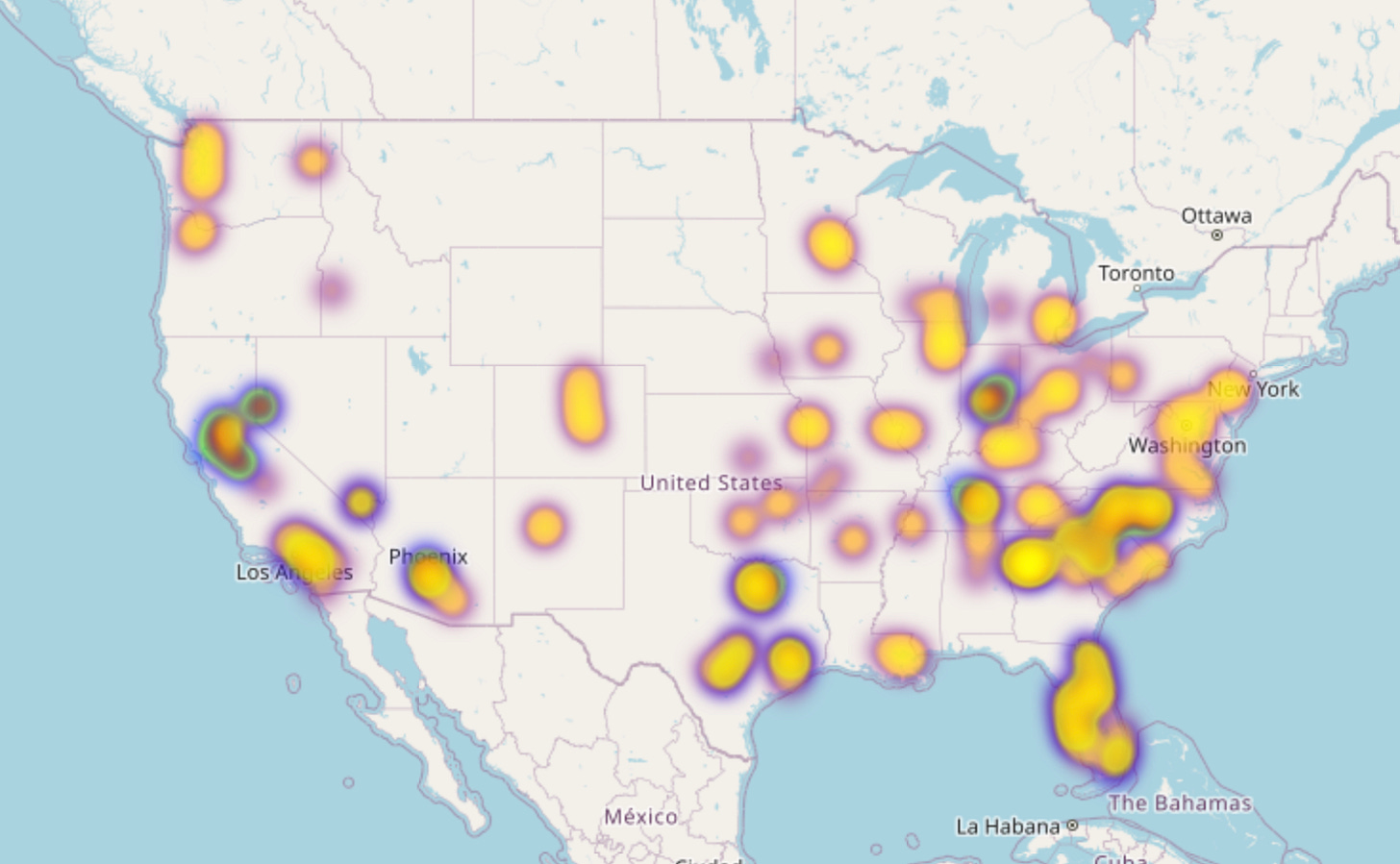

While Tricon’s portfolio is held mostly across the Sunbelt, HPA has greater geographic diversity with a presence nearly nationwide.

Tricon Portfolio

Home Partners of America Portfolio

Combined Portfolio

Tricon has a smaller geographic footprint than HPA. Almost all markets where Tricon owns homes are markets where HPA already has a presence. This overlap may simplify the integration of Tricon’s assets compared to integrating a portfolio introducing many new markets.

This transaction bolsters Blackstone’s exposure in core SFR markets, many of which weren’t heavily accounted for in HPA’s portfolio. Markets such as Seattle, Chicago, and Colorado Springs, which are relatively large in HPA's portfolio, have not been popular markets for other SFR players over the past five years.

Interestingly, the combination of these two portfolios doesn’t catapult Blackstone to dominate any one market. While HPA was already operating in Tricon’s markets, their footprint was relatively small and the addition of the Tricon portfolio didn’t turn any core SFR market into one particularly dominated by Blackstone.

Purchase Price Distribution

HPA properties tend to be much higher in dollar purchase price than homes part of Tricon’s portfolio.

Year Built Distribution

While meaningful differences exist in purchase price, the distribution of year built for homes owned by HPA and Tricon are similar.

Square Footage Distribution

Meaningful differences exist in property square footage between homes owned by HPA and Tricon, with HPA homes being considerably larger.

School Ratings

The distribution of ratings for schools near homes owned by HPA is good, in line with the distribution for American Homes 4 Rent and Invitation Homes. The distribution of ratings for Tricon is slightly lower, though remains above those for workforce housing providers like SFR3 and VineBrook.

Market-Level Gross Yields

Gross yields vary significantly across markets for HPA and Tricon, and even between portfolios in the same market.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.