Q3 2024 Private Lender Report

Insights on Top Private Lenders, Market Trends, Metro-Level Analysis, and Borrower Activity

Executive Summary

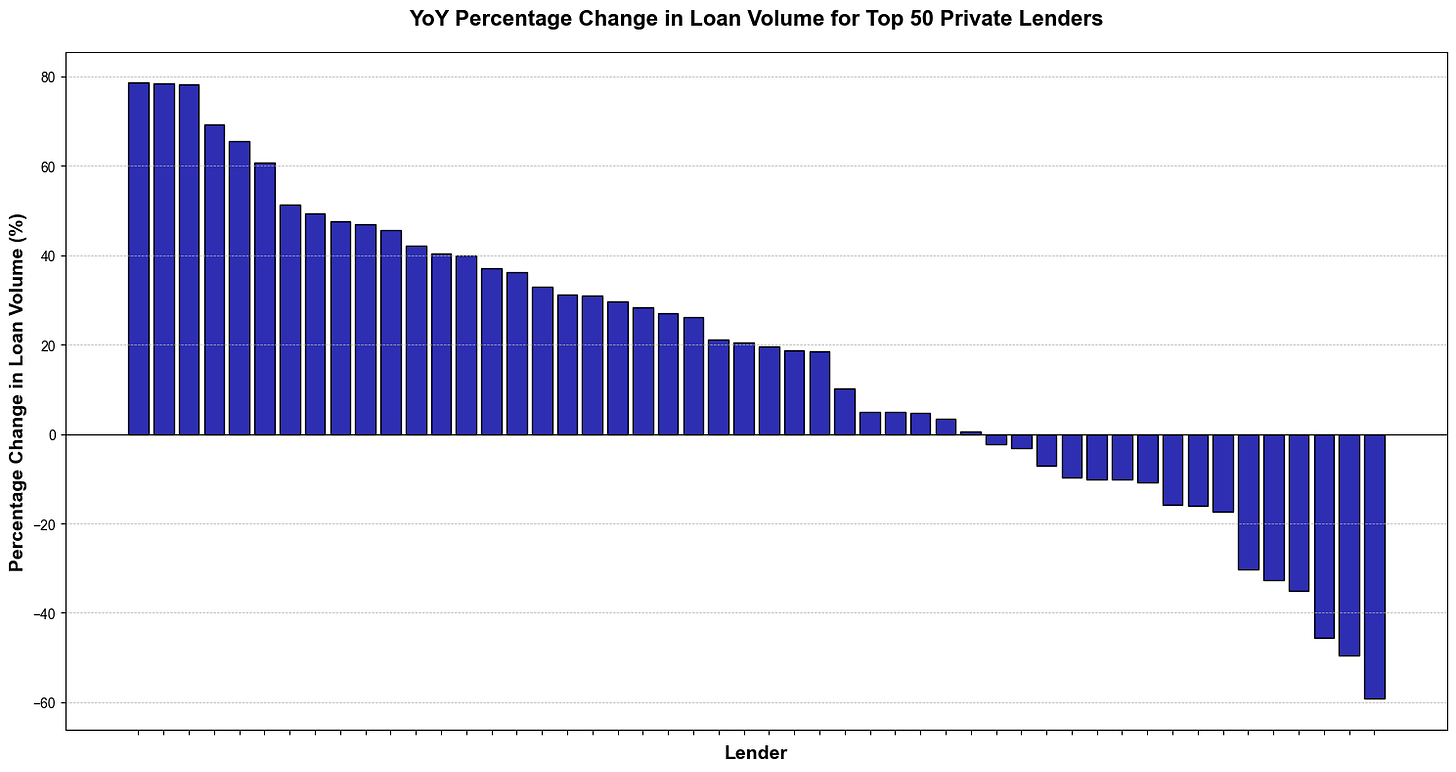

Private lender originations have remained relatively flat, but most of the top 50 lenders have increased their origination volume year-over-year (YoY).

The past few months have been eventful for major private lenders:

Kiavi, Genesis, and Toorak all had rated securitizations.

Two lenders less than a year old, Encore and CV3, approached or surpassed $1 billion in origination volume.

Kiavi broke its previous record for originations in a single month, reaching $625 million in July 2024.

SFR Analytics Private Lender Tool

Interested in tracking private lender activity nationwide in real-time, including access to borrower lists with contact information? Reach out to support@sfranalytics.com for a demo of the SFR Analytics Private Lender Tool.

This is the only private lender analytics software offering nationwide coverage, supporting every metro area in the U.S.

In addition to tracking private lending activity, the tool also provides:

Insights on cash buyers

Current property holdings for entities

Contact information for hundreds of thousands of borrowers

Dozens of originators rely on the SFR Analytics Private Lender Tool to close more deals, successfully enter new metros, and gain a better real-time view of the market.

Next week, we’re releasing a major update with expanded functionality, including:

Loan type data

Improved contact info quality

Revamped design

And more

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the single-family rental market. To generate this analysis, we:

Identified and reconciled entities that private lenders use to make loans

Identified and reconciled entities used by investors to purchase properties

While the data is primarily residential, it also includes some commercial originations.

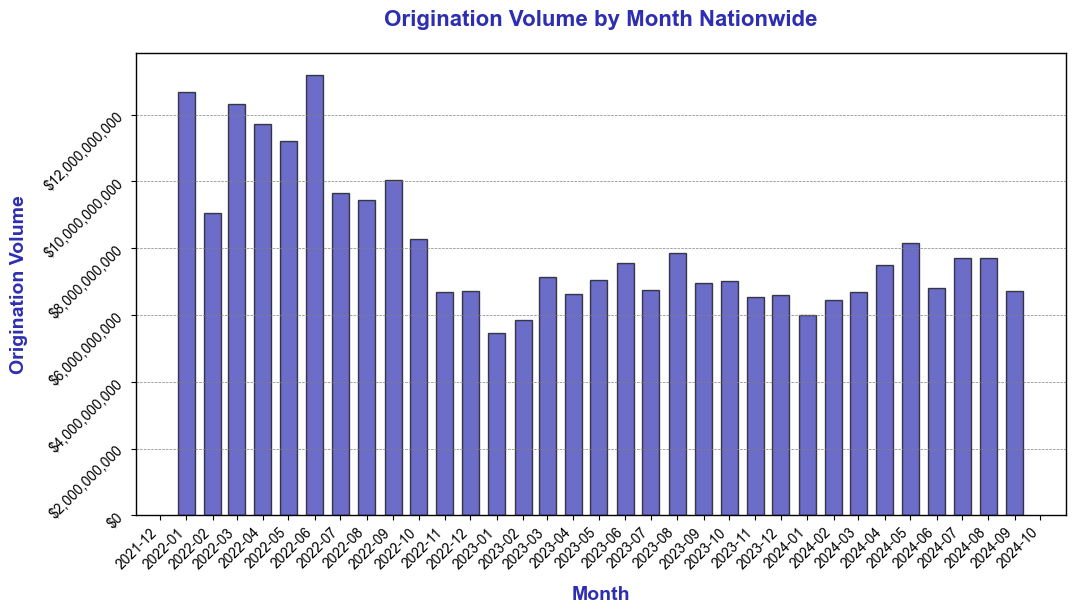

Total origination volume has stabilized after peaking in early 2022, remaining steady over the last 18 months.

Although origination volume industry-wide has stayed flat, 70% of the top 50 lenders have grown YoY, with the median top 50 lender growing over 20%. This aligns with what we’ve heard from the lenders we work with: many smaller lenders are struggling to compete with larger ones or find an untapped niche.

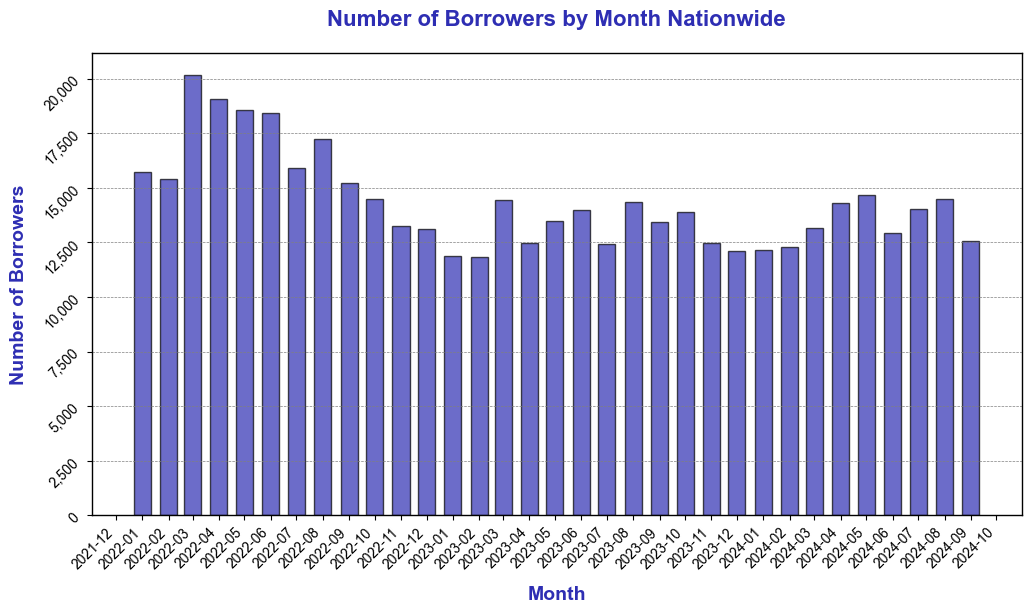

The number of borrowers has also remained flat. Several house flippers we've spoken to, who haven’t been acquiring properties since interest rates rose, have expressed optimism about flipping again in 2025 if rates decrease.

Metro Analysis

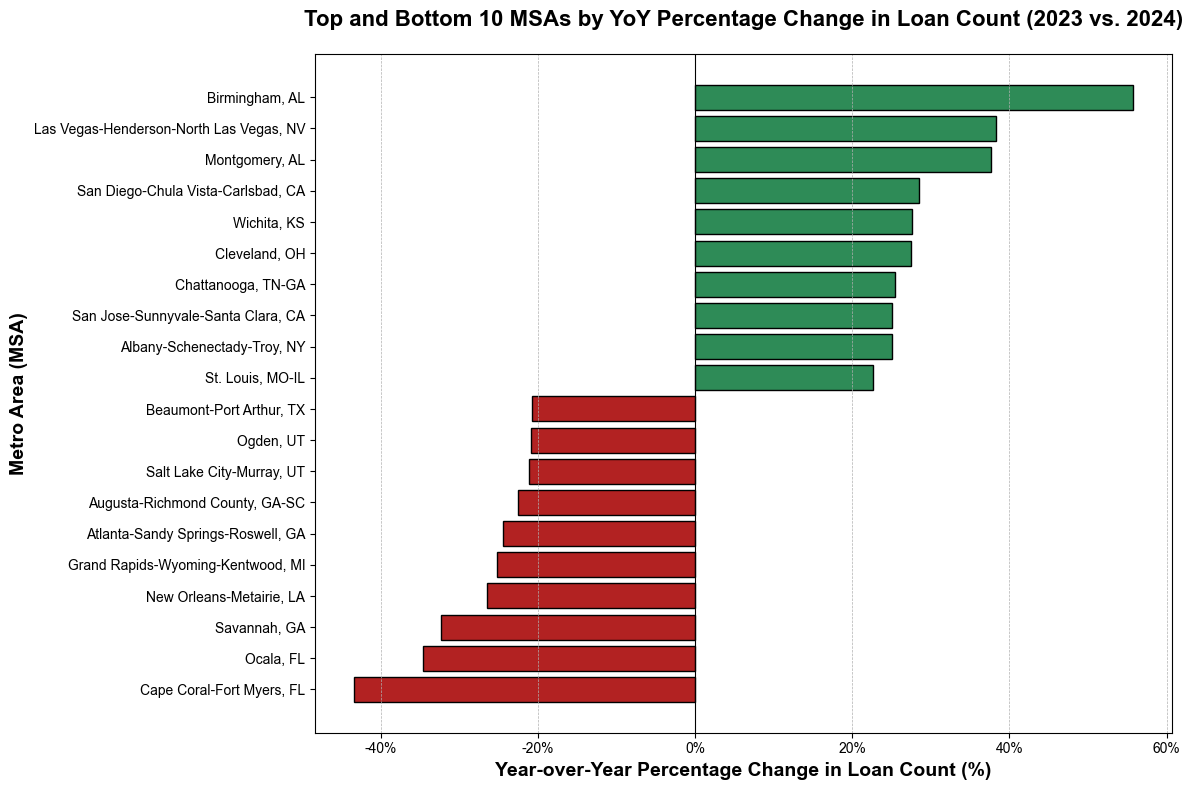

Florida and Georgia have been hit hardest, containing five of the ten metros with the largest decreases in loan volumes.

Meanwhile, Alabama and some California markets have seen some of the largest increases in loan counts YoY.

DSCR Analysis

We recently added loan type data to our dataset, allowing us to differentiate between DSCR and Bridge originations. Ten metro areas account for more than one-third of DSCR originations, with Philadelphia and Baltimore leading the way.

Contact Us

Interested in tracking private lender activity nationwide in real-time, including access to borrower lists with contact information? Reach out to support@sfranalytics.com for a demo of the SFR Analytics Private Lender Tool.