Q1 2025 SFR REIT Earnings

Analyzing Q1 2025 results from Invitation Homes (INVH), American Homes 4 Rent (AMH).

This post is brought to you by Utility Profit

Turn Internet Into Income

Earn ~$100K for Every 1,000 Homes

Utility Profit makes it easy for institutional SFR operators to unlock new revenue — just by helping renters save on internet.

We partner with top telecom providers so you can offer exclusive, below-retail internet plans at your properties. Tenants get great service at a discount, and you boost your NOI without lifting a finger.

On average, operators earn around $100,000 per 1,000 homes. We take care of billing, equipment, and support so there’s no extra work for your team.

Curious how it works? Book a demo to see it in action.

Executive Summary

Invitation Homes (NYSE: INVH) and American Homes 4 Rent (NYSE: AMH) have built a combined portfolio of 145,000+ single-family rental properties across the country.

While these REITs experienced annualized rent growth exceeding 10% during stretches of 2021, pricing power has diminished significantly, with blended rent growth now in the 3-4% range. The Q1 2025 reports reveal divergent performance in new lease rent growth, with INVH reporting -0.1% and AMH achieving a more positive 1.4%. Market weakness is particularly evident in cities like Phoenix, where INVH reported new lease rent growth of -2.4%.

Despite softness in new leases, both REITs maintained solid renewal rent growth (5.2% for INVH and 4.5% for AMH), demonstrating their ability to retain existing tenants at higher rates even as market conditions fluctuate. This dynamic reflects the high-friction nature of moving, which allows REITs to maintain higher renewal rates than what new market leases might suggest.

The spring 2025 leasing season shows signs of improvement, with both companies reporting strengthening metrics in late Q1 and early Q2. INVH saw March new lease rate growth at 1.3% with preliminary April figures reaching 2.7%, while AMH reported improved April metrics with new lease growth of 3.9%. Same-Store occupancy remains strong at 97.2% for INVH and 95.9% for AMH.

Both REITs continue to adapt their growth strategies, with INVH acquiring 631 homes in Q1 while AMH delivered 545 newly constructed homes through its development program, signaling the industry's increasing focus on built-to-rent as an alternative acquisition channel in a challenging purchasing environment.

Introduction

Single-Family Rental (SFR) Real Estate Investment Trusts (REITs) have become a prominent player within residential real estate. As of Q1 2025, the two major publicly listed SFR REITs (Invitation Homes and American Homes 4 Rent) own a combined 145,000+ homes, following Blackstone's acquisition of Tricon Residential which was completed in 2024 (to read more about the details of the deal, read our analysis). Both REITs were founded in 2012 and began acquiring properties in the early recovery period following the 2008 global financial crisis; Invitation Homes scaled most aggressively, buying ~40,000 homes in 2012-2013 alone.

The Sun Belt continues to be the primary focus for these SFR REITs, offering attractive underlying population and employment growth paired with reasonably priced homes relative to prevailing rental yields. While traditional acquisition pace has slowed with funds struggling to find properties that offer attractive yields, both REITs continue strategic growth through various channels. INVH acquired 631 homes in Q1 2025, while AMH is leveraging its development program, delivering 545 newly constructed homes in Q1 2025 alone. This shift toward development highlights the industry's adaptation to market conditions that have driven a rise in interest for built-to-rent (BTR) projects.

While renewal rent growth remains resilient at 4-5% for both REITs, new lease rent growth has softened significantly. INVH reported -0.1% new lease growth in Q1 2025 (with negative growth in markets like Phoenix at -2.4% and Jacksonville at -2.3%, while Southern California represents a standout performer with 5.2% new lease growth), while AMH achieved 1.4% new lease growth. However, both companies are seeing improving trends as the spring leasing season progresses, with INVH reporting preliminary April new lease growth of 2.7% and AMH reporting 3.9%. This dynamic demonstrates how SFR REITs can maintain moderate renewal rent growth with existing occupants even as market rates fluctuate. New lease rent growth remains a critical leading indicator for future renewal growth potential, as the gap between existing lease rents and market rents influences tenant retention and pricing power.

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and rental listing data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that INVH and AMH have purchased homes under.

Aggregated additional sources of data, like school ratings, to provide additional context about the neighborhoods where properties are held.

Note: A more detailed breakdown of data and methodology used is available at the bottom of the post.

Analysis & Results

Invitation Homes

Year over year, in Q1 2025, total revenues increased 4.4% to $674 million, and property operating and maintenance costs increased 3.1% to $237 million. Net income available to common stockholders increased 16.4% to $166 million or $0.27 per diluted common share.

Same Store Average Occupancy was 97.2%, down 60 basis points year over year. Same Store renewal rent growth of 5.2% and Same Store new lease rent growth of -0.1% drove Same Store blended rent growth of 3.6%. Same Store Bad Debt improved 10 basis points year over year to 0.7% of gross rental revenue. March new lease rate growth was 1.3%, with preliminary April new lease rate growth at 2.7%.

Acquisitions by INVH and joint ventures totaled 631 homes for approximately $213 million while dispositions totaled 470 homes for approximately $179 million. S&P Global Ratings reaffirmed INVH's 'BBB' issuer and issue-level credit ratings and upgraded its outlook to 'Positive' from 'Stable' in April 2025, with AMH receiving the same outlook upgrade from S&P during the same month.

American Homes 4 Rent

Rents and other single-family property revenues increased 8.4% year-over-year to $459.3 million for the first quarter of 2025. Core Net Operating Income ("Core NOI") from Same-Home properties increased by 4.4% year-over-year for the first quarter of 2025.

Same-Home Average Occupied Days Percentage of 95.9% in the first quarter of 2025, while generating 1.4% rate growth on new leases and 4.5% rate growth on renewals, resulting in 3.6% blended rate growth. Preliminary April metrics showed further improvement with Same-Home Average Occupied Days Percentage of 96.3%, rate growth on new leases of 3.9% and rate growth on renewals of 4.4%.

Geographic Distribution

INVH

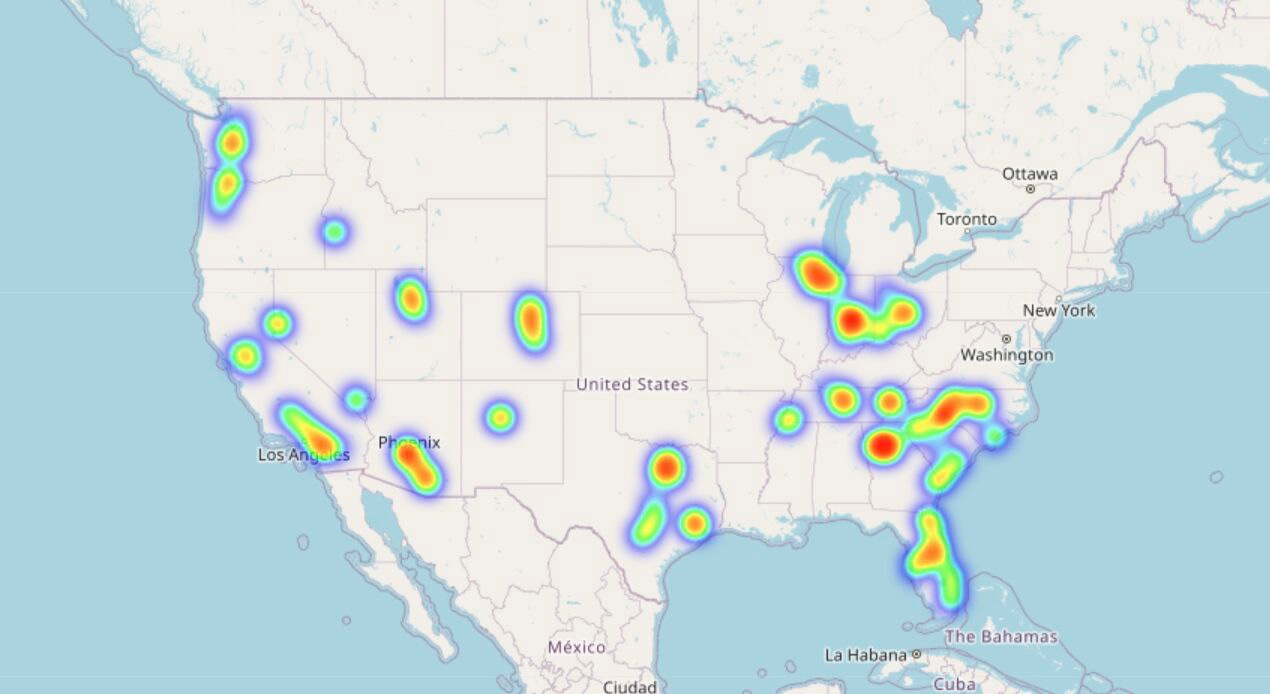

INVH has built an 85,261 home portfolio spanning the country, with major presence in the Southwest and Southeast. As of Q1 2025, Invitation Homes maintains its strongest presence in Florida, where its combined markets (South Florida, Tampa, Orlando, Jacksonville) account for approximately 26,560 homes, or about 31% of its portfolio. Atlanta represents another significant concentration with 12,598 properties, while California (Southern and Northern combined) accounts for approximately 11,320 homes. Other notable markets include Phoenix (9,223 homes), the Carolinas (6,066 homes), and Seattle (3,944 homes).

AMH

AMH has built a 60,700 home portfolio (excluding properties held for sale) as of Q1 2025. The company maintains a geographically diverse footprint with its top three markets being Atlanta (6,038 homes, 9.9%), Charlotte (4,254 homes, 7.0%), and Dallas-Fort Worth (3,839 homes, 6.3%). By state, Florida markets (Jacksonville, Tampa, Orlando) comprise approximately 8,489 homes, Texas markets (Dallas-Fort Worth, Houston, San Antonio) total about 7,454 homes, and North Carolina (Charlotte, Raleigh) accounts for roughly 6,465 homes. AMH continues to maintain a stronger Midwest presence than INVH, with approximately 4,284 homes in Ohio (Columbus, Cincinnati) and 3,049 homes in Indianapolis alone, representing about 12% of their portfolio.

Rent Growth

Regional performance divergence continues across the SFR REIT portfolios, with Western markets generally outperforming Southeastern markets for INVH, while AMH's Midwest markets show particular strength.

Southern California represents a standout performer for INVH with 5.2% new lease growth and 6.5% renewal growth, driving robust 6.2% blended growth and maintaining strong 98.1% occupancy.

Chicago area emerges as AMH's strongest market with exceptional 8.4% new lease growth and 6.6% renewal growth, resulting in market-leading 7.1% blended growth despite AMH's generally more moderate growth metrics.

Phoenix demonstrates consistent weakness for both REITs (INVH: -2.4%, AMH: -1.1% new lease growth), suggesting broader market challenges rather than operator-specific issues in this previously high-growth Sun Belt market.

Florida markets show pressure on new lease pricing, with INVH reporting negative new lease growth across all Florida markets (South Florida: -1.3%, Tampa: -2.5%, Orlando: -1.4%, Jacksonville: -2.3%), while AMH shows mixed but generally better results in the same region.

Market-level operating metrics reveal AMH's advantage in new lease growth performance across similar markets, suggesting potential differences in pricing strategies or property quality positioning between the two REITs.

Despite varying market conditions, both REITs maintain strong occupancy levels (INVH: 97.2%, AMH: 95.9%), demonstrating the resilience of the single-family rental business model even in markets experiencing pricing pressure.

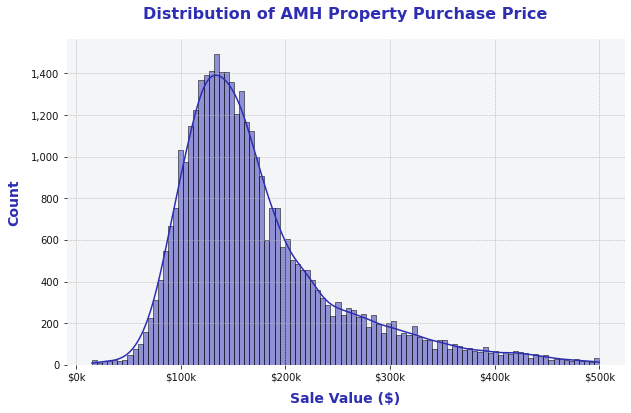

Purchase Price Distribution

School Ratings

Invitation Homes and American Homes 4 Rent have a higher median GreatSchools rating for schools near portfolio properties, slightly ahead of Tricon. Workforce housing providers like VineBrook and SFR3, which focus on affordability, have notably lower distributions of GreatSchools ratings.