Q1 2024 Private Lender Report

Top lenders, market commentary from active lenders, metros with largest changes in activity, borrower loyalty, and more.

Executive Summary

Private lending origination volume was down 4.5%+ in Q1 2024 compared to Q4 2023; compared year-over-year to Q1 2023, origination volume was up 2.5%; since reaching a low in January 2023, activity held flat to slightly positive.

Kiavi is the leading nationwide provider of fix-and-flip loans, holding the #1 market share position in 20 different markets as of March 2024.

Private lending regionally continues to be served by a long-tail of providers, with almost all regions having 50+ lenders completing 10+ loans in Q1 2024 alone.

At the end of the article, paid subscribers have access to lender-level borrower history lists generated by the SFR Analytics Private Lender Tool.

SFR Analytics Private Lender Tool

Interested in being able to track private lender activity nationwide in real-time, including getting access to borrower lists for each lender with borrower contact information? Reach out to support@sfranalytics.com for a demo of the SFR Analytics Private Lender Tool.

The only private lender analytics software that offers nationwide coverage, supporting every metro in the US.

In addition to tracking private lending activity, the tool also provides coverage of:

Cash buyers

Current holdings for an entity

Contact information for hundreds of thousands of borrowers

Dozens of originators choose the SFR Analytics Private Lender tool to close more deals, enter new metros successfully, and get a better real-time view of the market.

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that private lenders make loans under

Identified and reconciled the entities that investor purchase properties under

While the data used is primarily residential, some commercial originations are also included

Analysis & Results

Nationwide Activity

Nationwide private lending volume continues to hold flat.

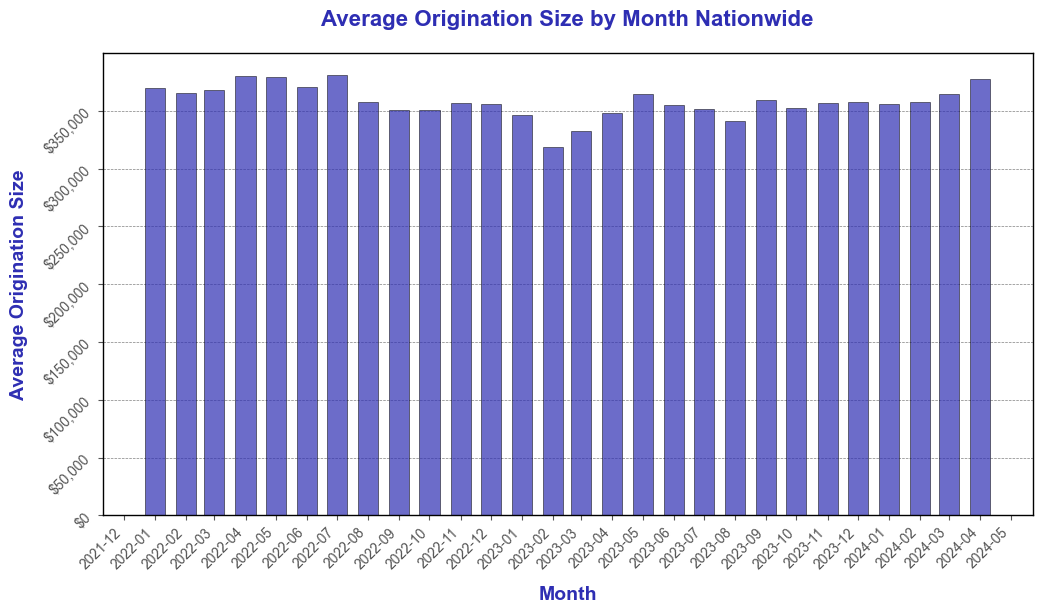

Despite the drop off in volume, average origination size has held steady from 2022 through 2024.

Part of the decline in historic origination volume can be explained by property investors exiting the market or slowing down and no longer taking loans, shown by the decrease in the number of unique investors taking out a loan in a given month.

Largest Regions by Loan Origination Volume

The largest regions by loan origination volume were Los Angeles, New York, Miami, Phoenix, and Dallas/Fort Worth.

MSA: Best QoQ Origination Volume Q1 2024 vs Q4 2023

Santa Maria-Santa Barbara, CA (+115.7%)

Las Vegas-Henderson-Paradise, NV (+45.5%)

Detroit-Warren-Dearborn, MI (+44.0%)

MSA: Worst QoQ Origination Volume Q1 2024 vs Q4 2023

Charleston-North Charleston, SC (-40.1%)

Bridgeport-Stamford-Norwalk, CT (-29.0%)

Portland-Vancouver-Hillsboro, OR-WA (-23.9%)

Most Lenders Have Increased Volume YoY

Of the top 100 private lenders in Q1 2023, 55 grew originations YoY.

The 25th percentile had a 23% decrease in production from Q1 2023 to Q1 2024; the 50th percentile had a 9% increase; the 75th percentile had a 38% increase.

Kiavi Market Position Over Time

Kiavi continues to be the leading nationwide fix-and-flip lender, ranking #1 in market share across 20 different MSAs profiled as of March 2024.

Local Dominance In Some Markets

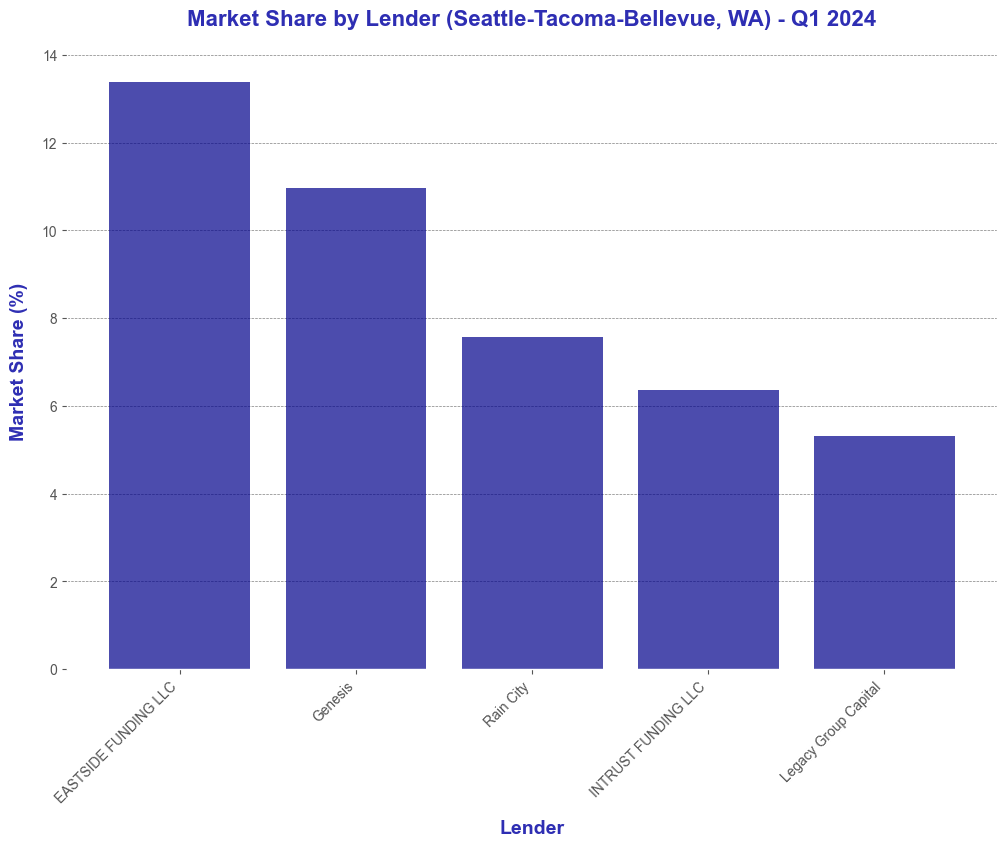

Despite Kiavi being the largest nationwide fix-and-flip lender, there are regional lenders with top market share in a few key markets.

In Phoenix, Capital Fund captured 14% of the market.

In Nashville, Bell Rock Finance secured over 10% of volume.

In Seattle, Eastside Funding grabbed over 13% market share.

Distribution of Active Lenders by MSA

Private lending supports a long tail of active lenders within MSAs. Most MSAs had 50+ unique lenders completing at least 10 loans in Q1 2024 alone.

Borrower Lists

Using the SFR Analytics Private Lender Tool, we’ve pulled lists for the most active borrowers year-to-date in 2024.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.