Opendoor Seller Personas

Demographics of homeowners that have sold homes to Opendoor versus alternative routes.

Executive Summary

Using a combination of transaction-level real estate data and individual-level demographic data, we looked at 3,000+ people who sold to Opendoor over the last six months to get a sense for the differences, if any, between people who sold their home to Opendoor versus people who sold via alternative routes. To control for differences in geography, we restricted non-Opendoor sale events to the 20 largest markets Opendoor operates in.

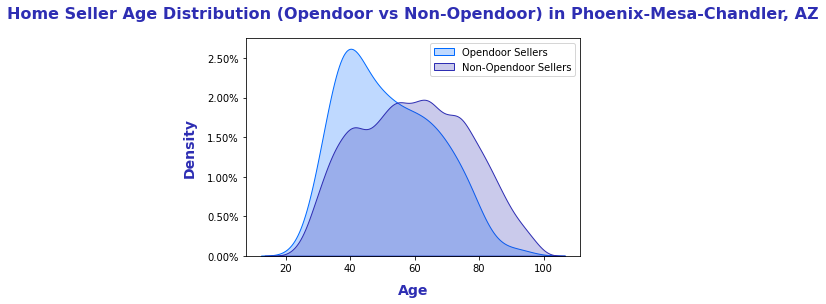

To date, people who have sold to Opendoor have skewed younger compared to people who sold their home via another route in the same regions and time periods.

While demographic trends may benefit Opendoor in the long run as a generation that grew up with technology begins to represent a larger proportion of homeowners, growing transaction volume in the near term may require buy box expansion paired with expanding customer acquisition methods.

Introduction

Opendoor has developed a consumer-friendly way for homeowners to sell, making digital “instant offers” and closing quickly with no work on the homeowner’s part to prep the home for showings. Using a debt facility, Opendoor holds these properties on its own balance sheet and performs light renovations before later listing the properties on the market. The company relies on significant engineering and analytics work to automate the offer making process and manage financial exposure risk. These days, the company buys more than 1,000 homes per month across dozens of markets nationwide, becoming a growing participant in the residential real estate market.

Using a combination of transaction-level real estate data and individual-level demographic data, we looked at 3,000+ people who sold to Opendoor over the last six months to get a sense for the differences, if any, between people who sold their home to Opendoor versus people who sold via alternative routes. To control for differences in geography, we restricted non-Opendoor sale events to the 20 largest markets Opendoor operates in.

For more information about Opendoor’s business model and recent performance, check out our post from last month.

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and demographic data to track the residential real estate market. To generate this analysis, we’ve:

Identified and reconciled the entities that Opendoor purchases homes under.

Matched individual-level demographic data to nationwide deed and assessor data to get the demographic characteristics of individuals that sold to Opendoor.

Analysis & Results

Age Distribution

People who have sold their home to Opendoor skew younger than sellers via alternative routes.

Income Distribution

People who have sold their home to Opendoor have disproportionately been in the middle of the income distribution. This makes sense, with Opendoor mostly avoiding rougher low-income areas while higher income individuals tend to be older and have higher value homes, some of which sit outside the buy box Opendoor has established.

Interested in leveraging individual-level nationwide demographic data to better understand your customers and improve marketing targeting? Reach out to support@sfranalytics.com to set up an intro call.

Ethnicity Distribution

Across markets Opendoor operates in, the company has bought more than the baseline rate from the category of All African American Ethnic Groups.

Metro Trends

Opendoor’s focus on younger sellers has been most apparent in states like Arizona and Florida that have large populations of older homeowners. Despite metro areas like Phoenix, Tucson, Jacksonville, and Tampa having a distribution of sellers that skews much older than the nationwide, sellers to Opendoor in these areas have remained roughly in line with the nationwide value with the most common seller age being around 40.

Persona Breakdown

Beyond age and income, our demographic dataset includes hundreds of categories in which the consumer is a known purchaser, such as gambling, running, and DIY projects.

These characteristics are rolled up into 129 distinct household personas. The three personas that Opendoor sellers overindexed on the most (250% to 300%+ higher percentage observed for sold to Opendoor versus alternative routes) are:

“Foundering Families” are married with children, living a pinched existence in large-scale suburban settings. Mom and Dad work hard at their jobs in healthcare support, production and food preparation & service--some may even be unemployed currently. Their less than average household incomes support their family's basic needs including food & beverages, utilities, healthcare, personal care and tobacco products. Occasionally there's some left over for that new outfit for mom, new toys for the kids or a new household appliance for their modest rental. "Foundering Families" enjoy getting together for dinner at their favorite fast food restaurant.

“Middle Class Mommies” are predominantly unmarried women taking care of children between the ages of three and five. These homeowners live in newer homes in mid-size suburban areas. They've earned their Associate's degree, which they've used to land jobs in the armed forces, law enforcement and administration. They use their somewhat less than average household income for transportation, food & beverages and personal care. In their rare free moments, "Middle Class Mommies" like to listen to the radio and try their luck with the lottery. Some of their more recent purchases may include large kitchen appliances, big-ticket home furnishings, toys, clothing and perhaps something for their dog.

“Family Focused” are married couples caring for children of all ages. You can find these families living in single family homes in mid-size suburbs, driving their full-size pick-ups or compact cars to their jobs in the armed forces and law enforcement. Although they have debt, with a household income slated mainly for transportation, food & beverages and personal care, "Family Focused" still find a way to buy new toys or spend a day at the local theme park.

The three personas that over indexed to not selling to Opendoor are (by 600% to 700%+):

“Family Fortune” are middle-aged married couples with children living a life of luxury in mid-size suburban settings. With their enviable incomes, these doctors, lawyers and financial consultants are able to afford the very best for themselves and their families including luxury cars, beautifully appointed high-end homes, designer apparel, gifts for friends & family and personal insurance. These families have also accumulated a substantial net worth with investments in stocks and mutual funds. For fun, "Family Fortune" enjoy reading magazines and taking lavish vacations to foreign locales. These families are also quite philanthropic and volunteer for charitable organizations near to their hearts.

“Regal Retirees” are mature empty nesters making the most of their golden years. Both singles and couples belong to this segment that's enjoying the good life, with generous fixed incomes that allow them to maintain and manage their posh homes, gas up their luxury cars, purchase catalog and internet must-haves, make contributions to causes they support and buy gifts for family and friends. In addition, this group also has an extremely healthy net worth with diverse portfolios that include stocks and mutual funds. "Regal Retirees" like to relax with a glass of wine or perhaps catch up on current events compliments of their local newspaper. This set also enjoys traveling and is probably either returning from, or planning, a luxurious cruise vacation or trip abroad.

“Affluent Aficionados” are a married, middle-aged and child-free segment who are living a comfortable lifestyle in the big city. As lawyers and financial representatives they've done well for themselves and have managed to accrue a tidy net worth. Their above average incomes allow them to indulge in the finer things in life like luxury cars, fine jewelry and trips to foreign countries. On the flip side, "Affluent Aficionados" are also quite philanthropic and volunteer for charitable organizations in their free time.

These personas help provide a better sense for the type of sellers who are more or less likely to use Opendoor to sell their home. In general, Opendoor's customers tend to be younger families with a median income.