Opendoor: Gross Margins Up, Acquisitions Down

Checking in on Opendoor's Most Recent Acquisition Cohorts

Executive Summary

Opendoor was the largest homebuyer in 2024 by a wide margin.

Challenging macroeconomic conditions have created significant headwinds for the iBuyer, resulting in annual acquisitions declining by more than 60% relative to 2022.

Despite ongoing corporate profitability challenges, Opendoor's recent monthly cohorts have demonstrated strong average gross margins — generating approximately $40,000 per home for acquisitions initiated since August 2024.

During Q4, Opendoor strategically reduced acquisition volume, emphasizing margin optimization over transaction quantity. The September-November 2024 period represented the only timeframe in which acquisition volumes fell below corresponding months in 2023.

Data Overview

SFR Analytics has a uniquely detailed view into the performance of Opendoor’s business through a two step process:

Entity matching and reconciliation

Ex: All legal entities like “OPENDOOR C LLC”, “OPENDOOR D LLC”, etc. are identified and linked back to Opendoor

Processing of nationwide deed and assessor data, updated daily

For all home sales nationwide, datapoints like the buyer, seller, sale date, sale amount, loan amount, property address, etc.

Note: properties in non-disclosure states have been excluded from the gross margin cohorts, due to limited price information available.

The combination of complete entity matching and reconciliation with daily updated deed and assessor data means visibility into all of Opendoor’s purchase and sale activity at the transaction level.

Analysis & Results

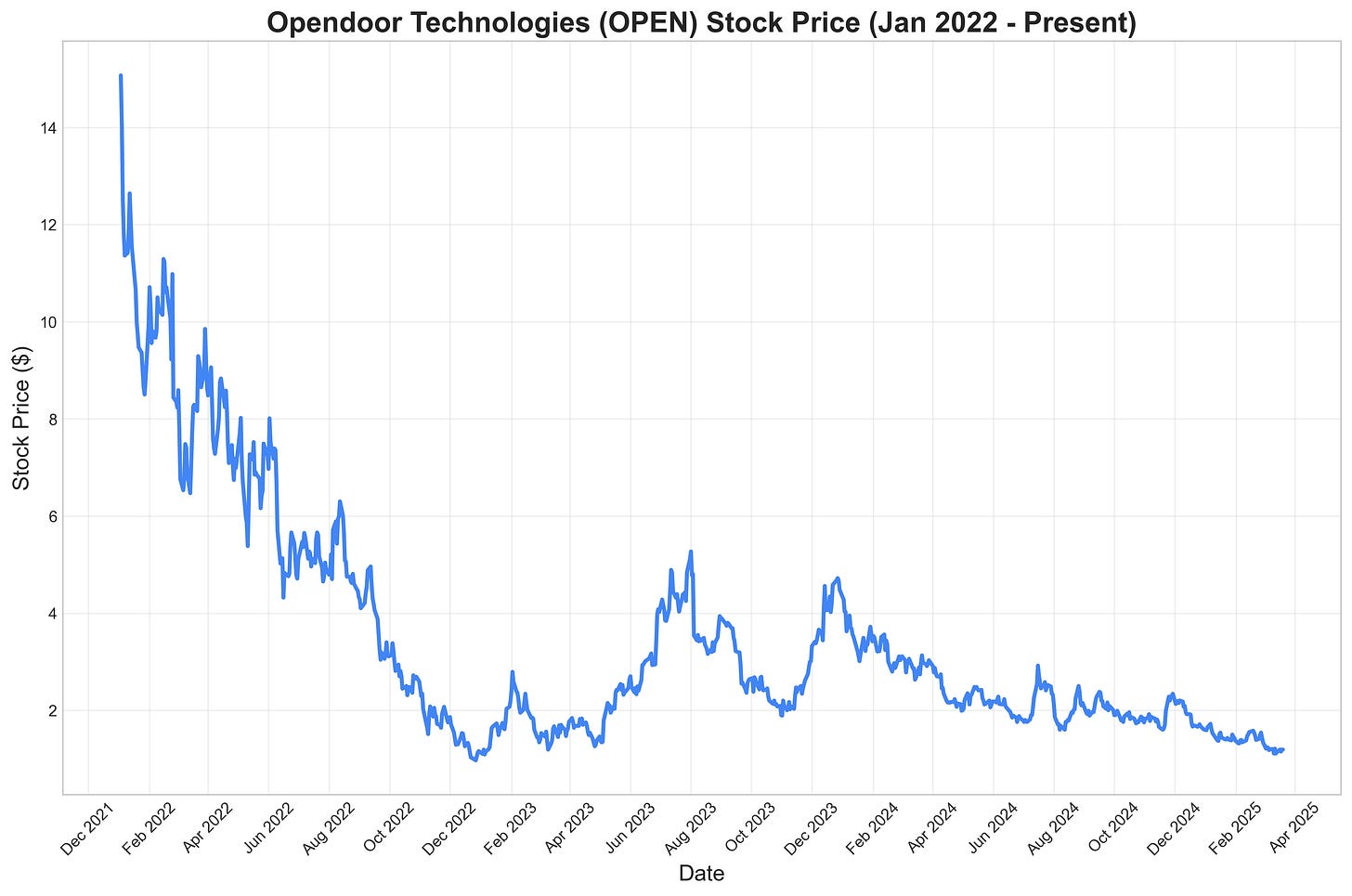

Opendoor (NASDAQ: OPEN) has had a difficult time in the public markets since listing via a SPAC in December 2020, with the stock trading down as much as 95% from the highs it reached in February 2021.

Opendoor ramped acquisitions in 2022 and faced large losses. By the end of 2022, Opendoor was purchasing 80%+ fewer homes than earlier in the year.

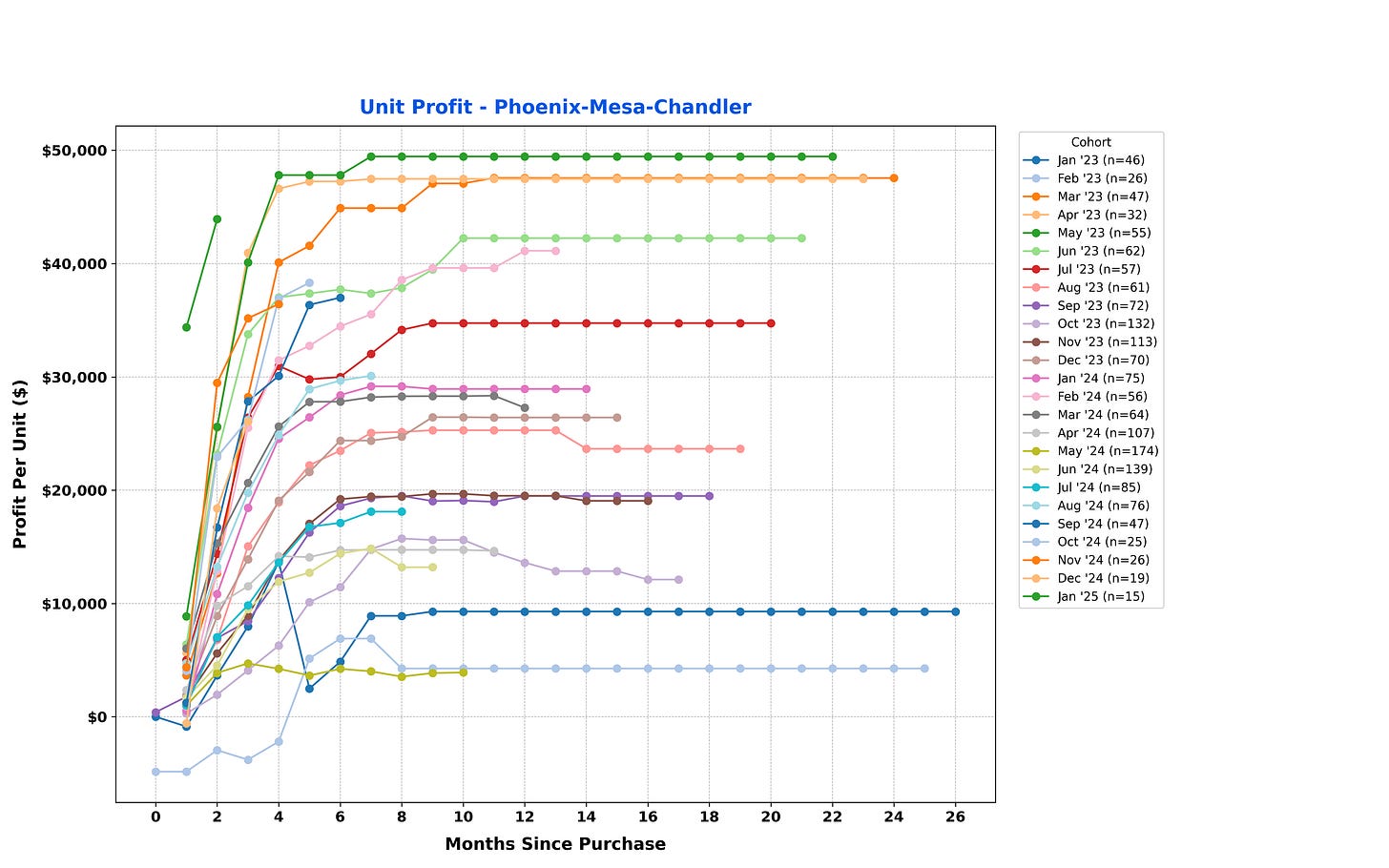

Phoenix was the poster child, accounting for 50%+ of the losses. The plot below shows the average gross margin per property cohorted by the month of acquisition. Opendoor's worst-performing purchases occurred during the months when the company bought the most properties.

In Phoenix, the company’s worst two months ended with losses of $60,000+ per property in gross margin on average.

Once rates started rising and losses began mounting, acquisitions plummeted throughout 2023 until gradually picking up acquisition pace through September 2024.

However, with ramped acquisitions came deteriorating gross margins. As Opendoor progressed through 2024, gross margins by monthly acquisition cohort steadily decreased.

In May 2024, the month with the most acquisitions, Opendoor recorded its lowest gross margins. While still positive, these were the lowest gross margins seen since 2022.

As Opendoor decreased acquisitions, gross margin improved significantly. By August 2024, Opendoor had started producing cohorts with similar gross margins as the stronger 2023 months. By scaling back further and acquiring fewer properties than in the same months of previous years, Opendoor effectively turned up the dial on margins for acquisitions.

While Opendoor seems to have a good grasp on how and when to adjust strategy to achieve profitable acquisitions, performance remains at the mercy of broader macroeconomic conditions.

The combination of constrained sales volume, minimal home price appreciation, and prevailing economic uncertainty imposes significant operational constraints on Opendoor's growth potential. Opendoor's most viable path to sustainable growth depends on an expansion of nationwide housing market activity, which would enable the company to benefit from a larger addressable market of prospective sellers.

Geographic Breakdown

Opendoor's largest markets are Atlanta, Dallas-Fort Worth (DFW), and Phoenix, but no single market dominates overall volume.

For paid subscribers, we provide detailed performance metrics at the local level below.

Market-Level Unit-Based Gross Profit

If interested in seeing row level details on Opendoor’s transactions, please reply to this email.