Executive Summary

Rent growth has remained strong across Ohio, increasing 4% to 6%+ year-over-year in major metro areas in 2023 after cooling from 6%-8% in 2022.

Inventory levels remain below pre-Covid levels across Ohio, down as much as 30% in regions like Cleveland compared to January 2020.

Ohio has been a popular state for large SFR operators, with an estimated 16,000+ single-family homes owned by institutional investors. Ohio is a popular state for privately held SFR funds like Vinebrook, SFR3, Conrex, Pretium, and FirstKey Homes.

At the end of the article, a CSV showing detailed information about investor ownership in Ohio for properties purchased during 2023 is available.

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that SFR investors purchase properties under to have a complete picture of acquisition and disposition activity.

Cleaned and processed historical rental listings data to generate annualized growth rates based on paired listings.

Identified “Same Store” properties that have been listed and removed multiple times over the period studied.

Investors are defined as buyers who used a private lender or corporate buyers excluding trusts. We think this is the best proxy, but will underestimate investment activity from non-corporate cash buyers.

Analysis & Results

Monthly Inventory

Inventory levels remain below pre-Covid levels across major regions in Ohio, with inventory in Cleveland down more than 30% compared to January 2020.

Inventory in Cincinnati has rebounded strongly from January 2023 lows of almost 2,000 to reach over 4,000 in April 2024, but that figure is still well below the value of almost 7,000 in March 2020.

Investor Acquisitions

Investor purchase activity dropped sharply in March 2020 through June 2020 before roaring back to reach highs in late 2021.

Since early 2022, activity has since fallen significantly, with rising interest rates changing the math on prospective purchases. Both flipping activity and new rental acquisitions are down significantly.

Ohio is a popular state for privately held SFR funds like Vinebrook, SFR3, Conrex, Pretium, and FirstKey Homes.

Note: the definition of investor purchase requires a corporate entity and ignores trusts, which frequently don’t reflect investor activity.

Looking for good investment properties?

Starting next week, you'll be able to view the top investment properties listed on the MLS using SFR Analytics listings data and analysis.

Investor Dispositions

Sale activity peaked in early 2022 and, like investor acquisition volume, has fallen significantly since. In early 2023, investor dispositions outpaced investor acquisitions during some months. Since then, investor acquisitions have outpaced dispositions.

It is worth noting that many of these investor dispositions are “natural dispositions” - often flippers exiting a property and selling it to an end user. Flipped properties often cycle from acquisition to disposition in 6-12 months.

Rent Growth by MSA

Rent growth has remained strong across most of Ohio over the past few years, clocking in at 4-6% year-over-year for most quarters. Akron appears to be slowing, having reached 8%+ year-over-year in early 2022 but below 4% in recent months.

Private Lending Market Share

Over the past 12 months, Kiavi has had the largest market share in Ohio by a wide margin, accounting for over 12% of private loans compared to around 6% for the handful of next closest lenders.

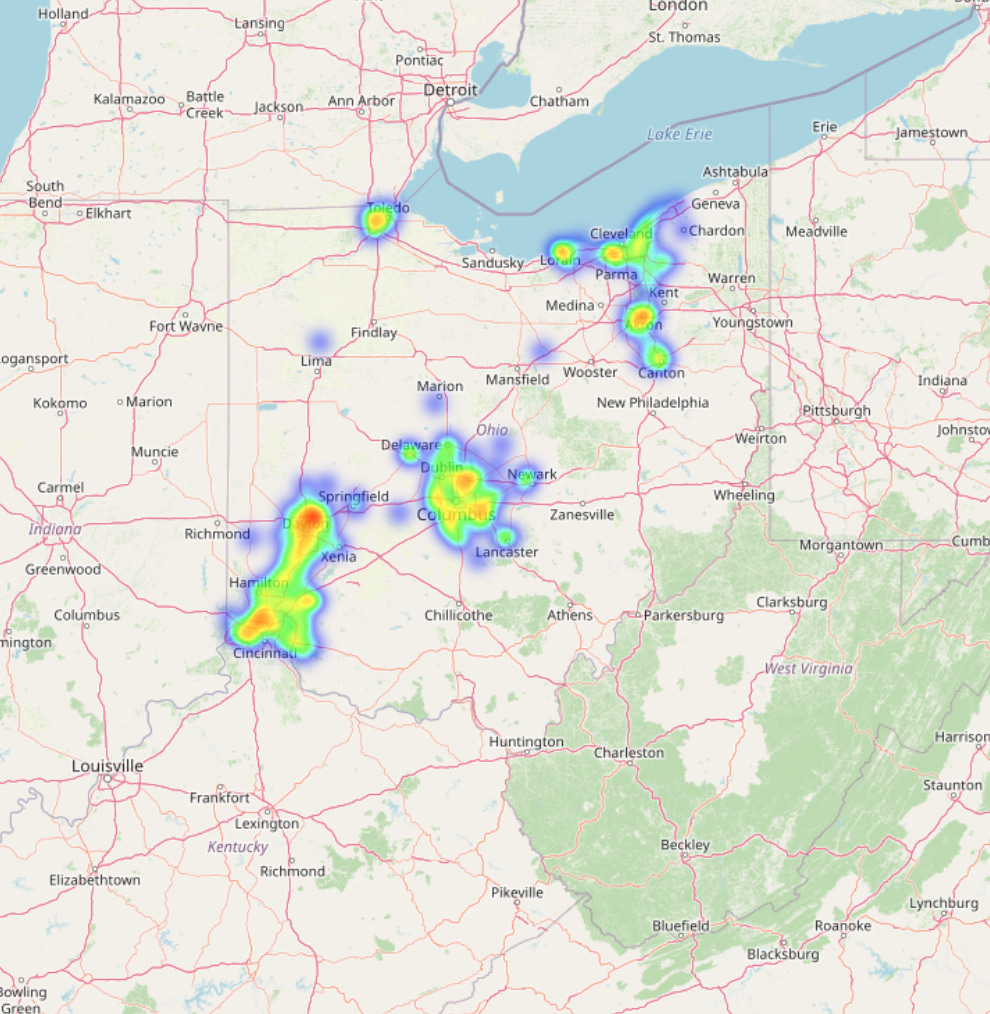

Institutional Ownership

Institutional investors have a strong presence in Ohio. We estimate that over 16,000 single-family properties in Ohio are owned by institutional investors.

Investor Ownership Details

While purchase volume is down from the heights of 2021, investors are still active in making acquisitions in Ohio.

A full list of properties purchased by investors across Ohio is available below:

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.