Kiavi Breaks Monthly Origination Record

April 2024 was the largest origination month in company history.

Executive Summary

Founded in 2013, Kiavi has grown to become the largest residential private lender with $4b+ in origination volume in 2023 and #1 market share across 20 different metros.

The company offers a variety of products to investors, including bridge, new construction, and DSCR.

In April 2024, Kiavi originated $588m in loans, an all-time high monthly total.

At the end of the article, a spreadsheet showing Kiavi’s loans originated in April 2024 is available

Introduction

Established in 2013, Kiavi is a leading private lender serving investors nationwide, operating across 32 states. Headquartered in San Francisco, Kiavi has grown rapidly since inception and raised significant venture capital equity ($350M+) and debt capital along the way.

While Kiavi has grown to be the largest private lender nationwide, the market still supports a long tail of smaller regional lenders. In 2023, almost all MSAs had at least 100 different lenders completing 10 or more loans. For more about Kiavi, see our breakdown from a couple of months ago.

After a slowdown in 2023, Kiavi is now setting origination volume records, nearing $600m of monthly originations.

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that fix-and-flip investors purchase properties under to have a complete picture of borrower activity and loyalty

Identified and reconciled the entities that Kiavi originates loans under

Analysis & Results

Origination Count & Volume

Origination count has continued to grow, exceeding 1,500 for April 2024, with over 1,200 different borrowers taking out a loan.

Kiavi posted an all-time high monthly origination volume of $580m in April 2024.

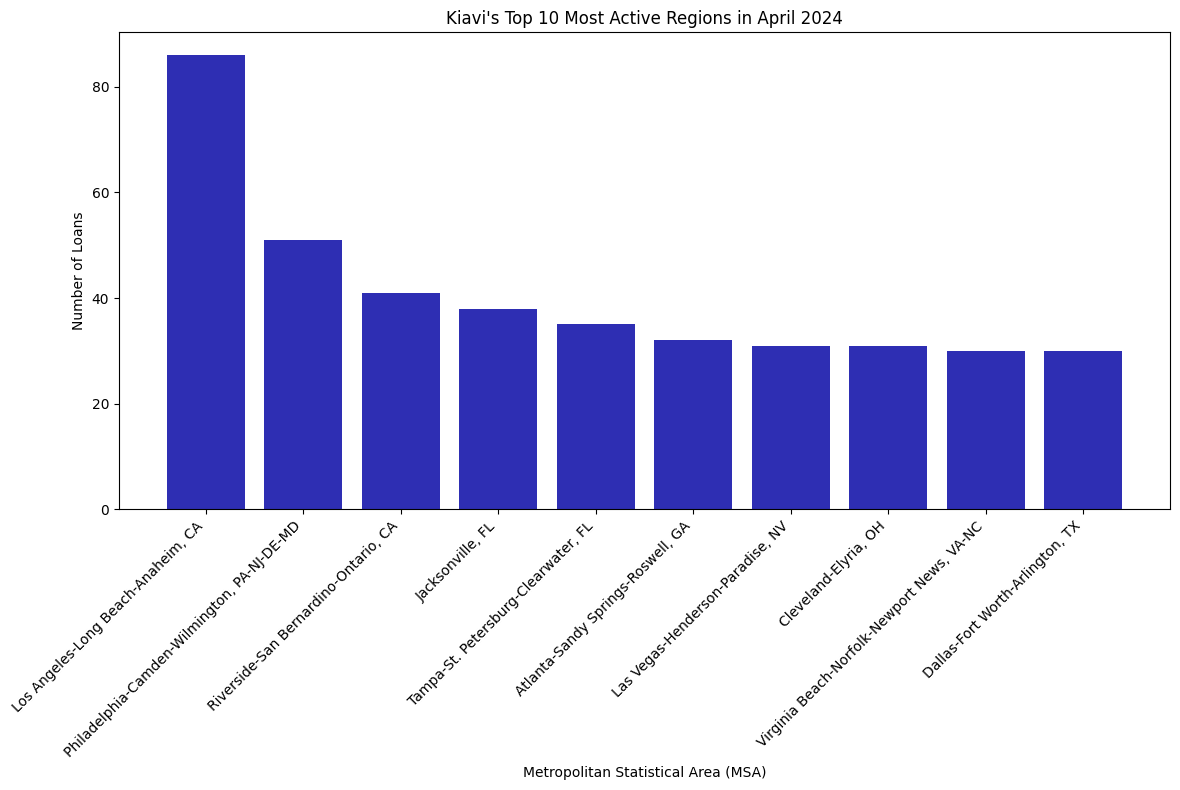

Most Active Geographies

Southern California is well represented, with Los Angeles and San Bernardino ranking at the first and third largest markets for Kiavi in April 2024.

Growth vs Other Lenders YoY

Many of the top lenders are growing year-over-year, with the fastest growing lender originating almost 3x more in volume comparing Jan-Apr 2024 vs Jan-Apr 2023.

Kiavi’s growth is impressive given its scale as the number one lender by volume, but the market has kept up and Kiavi hasn’t made large leaps in nationwide market share, currently sitting at ~8% of the residential private lending market.

Geographic Distribution

While Kiavi operates nationwide, the company has a particularly strong presence in Southern California, with LA and the Inland Empire being two of their top three markets by origination volume. Kiavi originates most of the loans taken out by GG Homes, a San Diego-based flipper which flips 100+ houses a year.

Transaction Details

At SFR Analytics, we track nationwide private lending activity. To see loan level details on the >1,500 originations Kiavi had in April 2024, you can access the spreadsheet below.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.