HEI Market Breakdown - Unlock, Hometap, Point, Splitero, Unison

Growing interest in home equity investment products has led to a competitive market with multiple originators offering homeowners upfront cash in exchange for a share of their home's future value.

Executive Summary

Home equity investment (HEI) products allow homeowners to stay in their home but receive cash in exchange for a share of the equity value of the home, typically converted on in the event of a future sale.

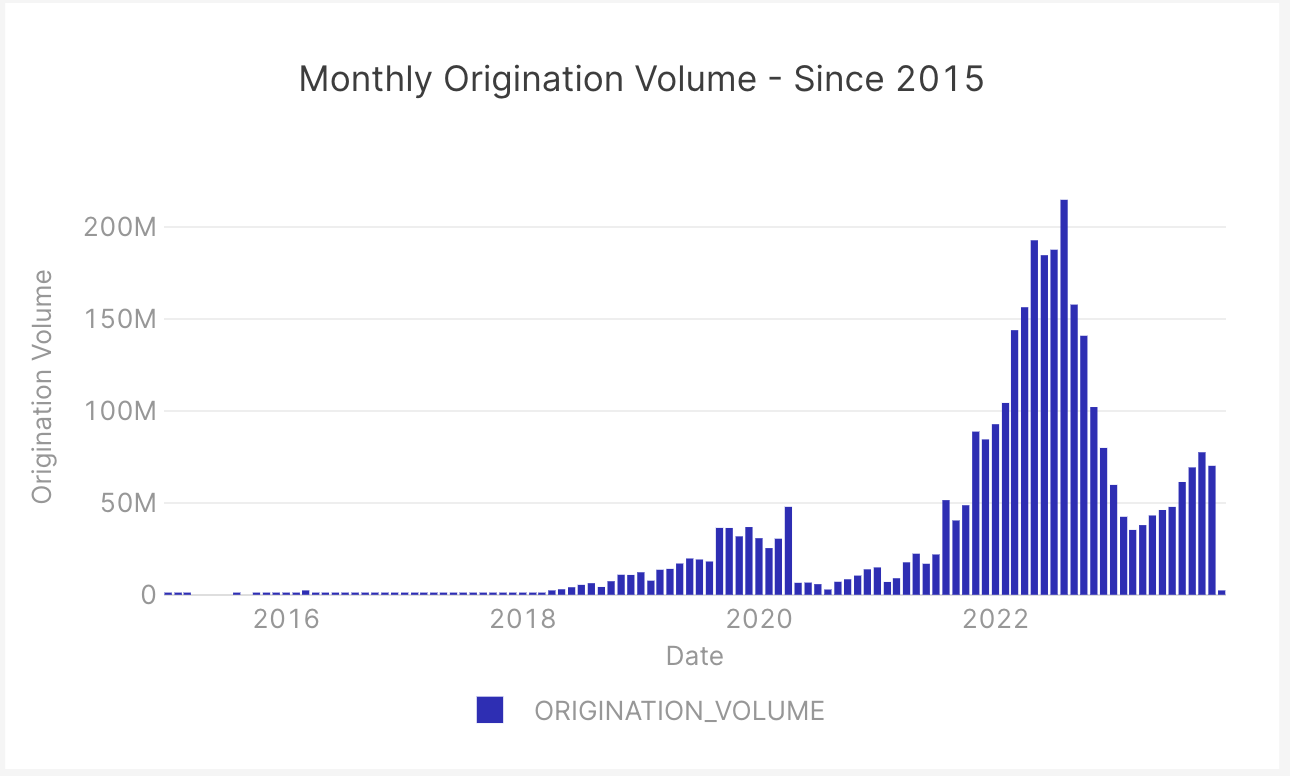

HEI volumes grew significantly during 2021-2022 as investors looked for ways to get exposure to single-family homes; volume has fallen significantly in 2023 with origination counts and volume down 60%+ from the peak in early 2022.

Leading players in the space include Unlock, Hometap, Point, Splitero, and Unison; recently, Redwood Trust has also begun originating HEIs.

Detailed information with real-time data covering the origination count and volume of specific originators broken down by time period and geography is available for paid subscribers at the end of the article.

Introduction

Home equity investment products have grown in popularity in recent years, allowing homeowners to tap into record nationwide levels of home equity without needing to leave their home, while allowing investors to get equity exposure to single-family homes with “management” handled by the existing homeowner who retains equity in the home and is incentivized to treat the property well.

HEIs are favorable for homeowners because they receive cash upfront, which can be used for any purpose. Additionally, because the product isn’t a loan, homeowners can take out HEIs even if they have poor credit. For investors, beyond HEIs being a “passive” form of exposure to single-family real estate, the smaller size of investment means that investors may more easily diversify their exposure across different geographies and properties without needing to operate at a large scale. Depending on the structure of the terms, one downside of HEI products for investors is that they can be illiquid, with uncertain payoff timelines.

Home equity investment products are different from home equity lines of credit (HELOCs). A HELOC is a debt instrument, structured as a revolving line of credit secured by the equity of a home. HELOCs require monthly payments, with interest paid on the amount drawn. In a HELOC, all equity in a home is retained, meaning that any appreciation in value accrues entirely to the homeowner, whereas an HEI is an equity-sharing investment where appreciation is split between the homeowner and investor.

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the residential real estate market. To generate this analysis, we’ve identified and reconciled the entities that various HEI operators have originated agreements under.

Analysis & Results

Origination Count & Volume

Origination count and volume started to grow steadily from early 2018 up until March 2020 before falling sharply during the early days of the COVID-19 pandemic. In 2021, the market began to rebound and by mid-2022 reached a peak of almost 2,000 originations a month and $200M+ in origination volume.

Due to macroeconomic challenges, many of the core HEI investors purchasing agreements pulled out of the market, leading to a shortage of capital. This caused a short-term 80% decrease in origination volume, with originators pausing customer acquisition and offers.

One example — Redwood Trust, a large financer of HEIs — stopped funding multiple originators and rolled out their own in-house originator (Aspire HEI), which has completed one origination to date.

Geographic Breakdown

While there has been HEI activity in a large number of states, by origination count and volume the product has been dominated by California, Arizona, and Florida, these three states alone accounting for 50%+ of the market in a given month.

Average Origination Amount

The average origination amount in the largest states for HEIs (California, Arizona, Florida) has grown over time, with California increasing from a typical amount of $100k in 2019 to $150k+ in 2023. Florida has grown from a typical range of $50k-$60k in 2019 to $100k in 2022, while Arizona has grown from $50k in 2019 to $100k since 2021.

HEI Activity by Originator

Access to property-level and transaction-level data supports further segmenting market activity data to look at the performance of individual originators over time, as well as further drill down to the performance of those originators within specific geographies.

In the section below, we take a closer look at the activity of Hometap and Point over time by geography.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.