EasyKnock's Sudden Closure - Analyzing The 1,000s of Homes Purchased

A breakdown of the types of properties purchased and homeowners' demographics

Executive Summary

EasyKnock, a leading residential sale-leaseback platform with nationwide operations, announced its abrupt closure on December 6, 2024. The company was founded in 2016 and had raised over $400M in equity and debt; the company had most recently closed a $28M Series D equity round in February from the venture arm of Northwestern Mutual.

The shutdown follows extensive legal challenges including multiple consumer lawsuits across several states and regulatory actions.

We analyzed both the types of properties purchased by EasyKnock and the demographic data of the homeowners that live in the properties.

Understanding EasyKnock and Sale-Leasebacks

Sale-leaseback arrangements offer homeowners a way to access their home equity by selling their property while continuing to live in it as tenants. This financial product emerged as an alternative to traditional home equity access methods, particularly appealing to homeowners who might not qualify for conventional financing options.

For more about the Sale-Leaseback market and similar offerings, check out our post: Sale-Leaseback Market Breakdown.

The EasyKnock Model

EasyKnock positioned itself as a technology-first solution for homeowners seeking to unlock their home equity. Their model centered on three key offerings:

Immediate access to home equity through property purchase

Guaranteed right to remain in the home as a tenant

Option to repurchase the property in the future

The company differentiated itself from traditional mortgage lenders by arguing that its transactions were pure real estate deals rather than loans, thereby falling outside the scope of mortgage regulations.

Homeowner Demographics

We were able to pull the demographics of the sellers who sold their home to EasyKnock to dive deeper into the characteristics of the sales leaseback participants.

Unsurprisingly, sellers to EasyKnock had a lower estimated net worth than sellers who sold via the MLS.

EasyKnock customers also had a much tighter age distribution, with most of them being between 40-60 years old.

The Path to Closure

Legal Challenges

EasyKnock's closure comes after facing significant legal and regulatory pressure:

Consumer lawsuits in multiple states including Texas, Maryland, South Carolina, Pennsylvania, and Ohio

State regulatory actions in Massachusetts, Michigan, and Connecticut

A December 2023 settlement with Massachusetts requiring permanent cessation of operations and a $200,000 payment

A May 2024 cease-and-desist order from Michigan citing deceptive business practices

Regulatory Concerns

The Federal Trade Commission had raised red flags about sale-leaseback transactions, specifically highlighting:

Substantial depletion of homeowner equity

Low success rates for property repurchasing

Instances of former homeowners facing eviction

Questions about consumer protection and transaction transparency

Data Overview

At SFR Analytics, we leverage nationwide deed and assessor data to track the residential real estate market. To generate this analysis, we’ve identified and reconciled the entities that EasyKnock originated agreements under.

EasyKnock's Market Footprint and Operations

Geographic Presence

Before its closure, EasyKnock maintained a nationwide presence, with particularly strong activity in:

Southeastern states

Major metropolitan areas

Growing suburban markets

Property Portfolio Characteristics

Analysis of EasyKnock's transactions reveals clear patterns in their target properties:

Median purchase price: $245,000

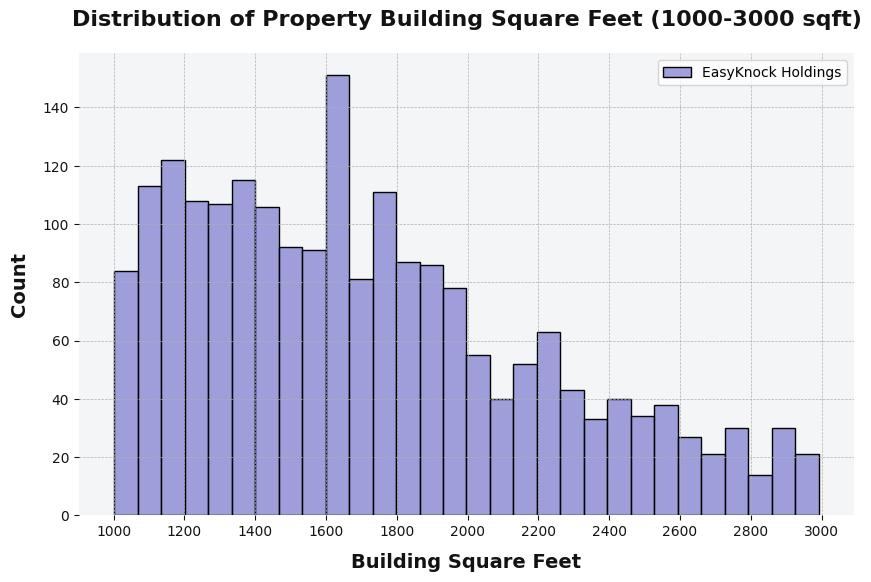

Average square footage: 1,648

Median year built: 1983

Primary focus on single-family homes in established neighborhoods

Industry Impact and Future Outlook

Remaining Market Participants

The sale-leaseback market continues to be served by several companies:

Truehold (primarily Midwest operations - largest markets being St Louis, OKC, Kansas City, and Cleveland)

Sell2Rent

StayFrank

Market Evolution

The closure of EasyKnock raises several questions about the future of residential sale-leasebacks:

Potential for increased regulatory oversight

Need for clearer consumer protection frameworks

Evolution of business models to address regulatory concerns

Role of technology in alternative real estate financing

Customer Implications

Current EasyKnock customers face uncertainty regarding:

Transition to NESE Property Management

Continuation of existing lease terms

Future repurchase options

Property maintenance and service expectations

All Transactions

Paying users can access a CSV of all of Truehold & EasyKnocks transactions below.