Brookfield has announced the acquisition of a majority stake in Angel Oak, a leading Non-QM lender managing $18B in assets. With over $30B in mortgage originations and 60+ completed securitizations, Angel Oak has established itself as a premier player in the alternative lending space. While Angel Oak provides a wide variety of Non-QM loans, we decided to look at their DSCR originations.

Angel Oak's DSCR Activity Analysis

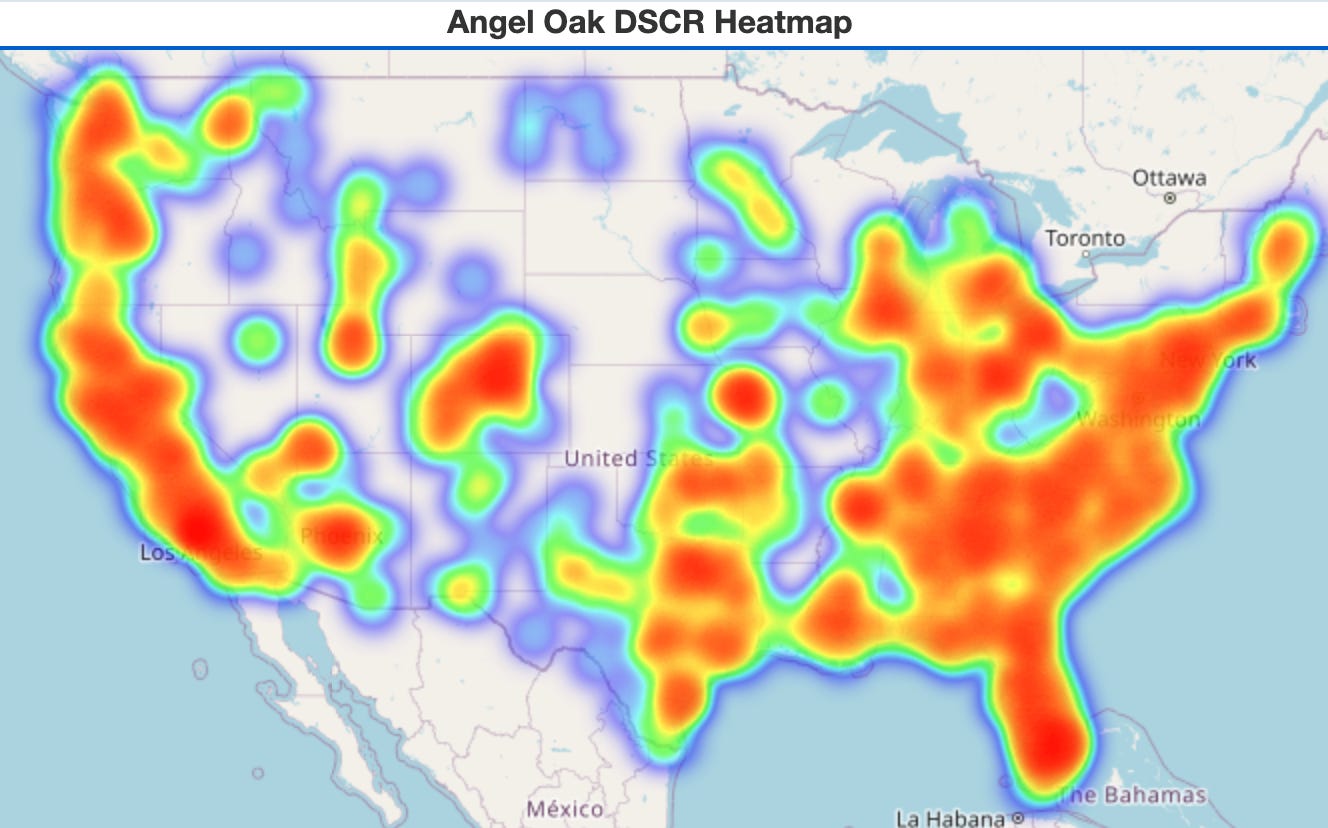

Angel Oak's DSCR production shows strong coastal preference, with Florida and California as their top markets. This pattern differs from broader market trends, as California typically shows lower DSCR loan volumes compared to high-activity states like Texas, Ohio, North Carolina, Georgia, and Pennsylvania.

Lender Ecosystem

Angel Oak DSCR borrowers demonstrate stronger overlap with conventional/typical Non-QM lenders rather than private lenders. This table illustrates the number of loans their borrowers obtained from other lenders in the past 12 months:

Notably absent from the top relationships are major DSCR private lenders such as ROC Capital, RCN, and LendingOne.

This pattern likely stems from Angel Oak's exclusive wholesale/correspondent business model, which relies on broker networks more aligned with traditional mortgage companies and typical Non-QM originators rather than private lenders.

Borrower Profile

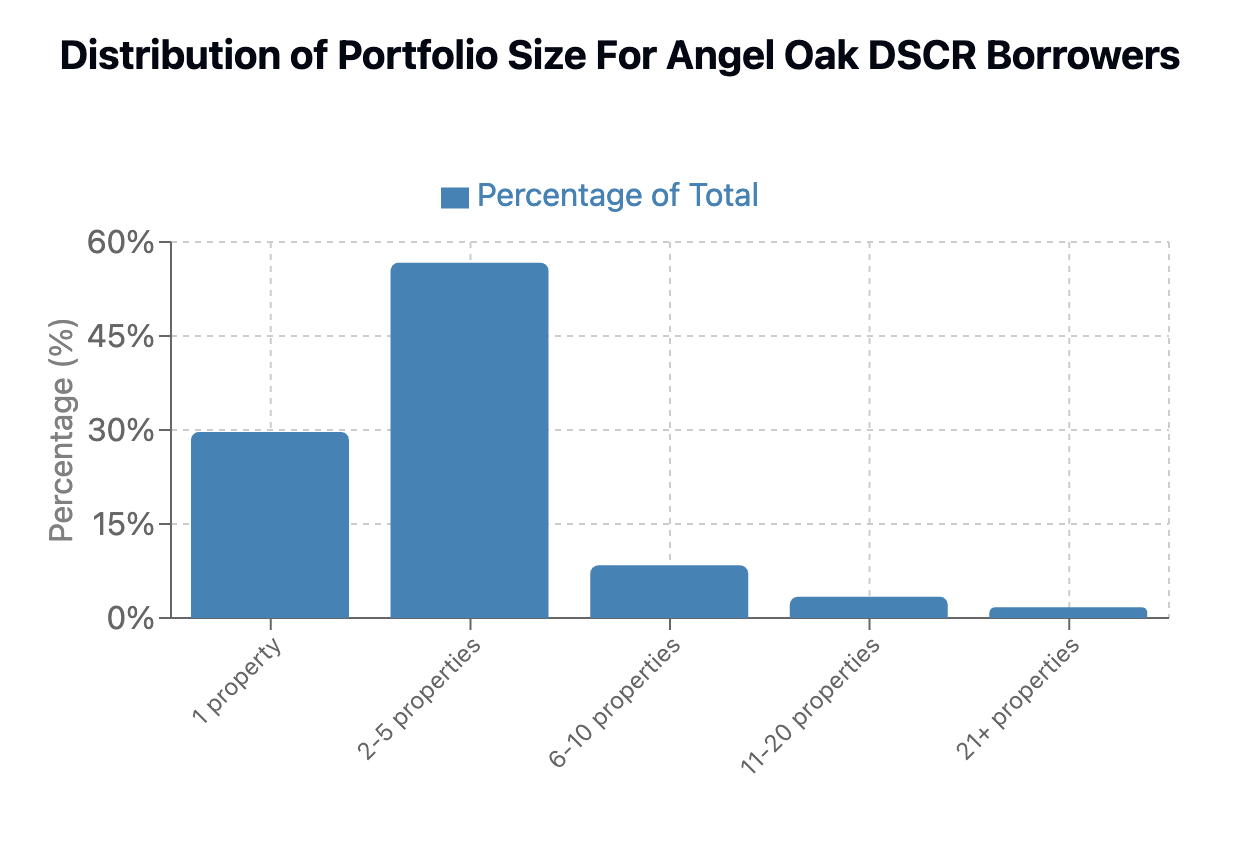

Angel Oak primarily serves smaller-scale investors, with our estimates indicating over 85% of their borrowers own five or fewer properties.

Market Outlook

The institutional appetite for all Non-QM products continues to strengthen, suggesting further acquisitions and strategic partnerships in this sector are likely.