2024 SFR Rental Acquisitions Overview

Investor purchase activity, gross yields by geography, and property characteristics across 2024.

In this data-driven analysis, we dive into single-family residential rental purchases made throughout 2024. Our comprehensive report includes:

A ranking of cities with the most residential rental purchases made, along with ranges of gross yields offered in those cities

A breakdown of the differences in purchasing behavior between institutional investors and non-institutional investors

Analysis of how property characteristics impact yields

Premium Content Preview

Here's a glimpse of what our paid subscribers will access:

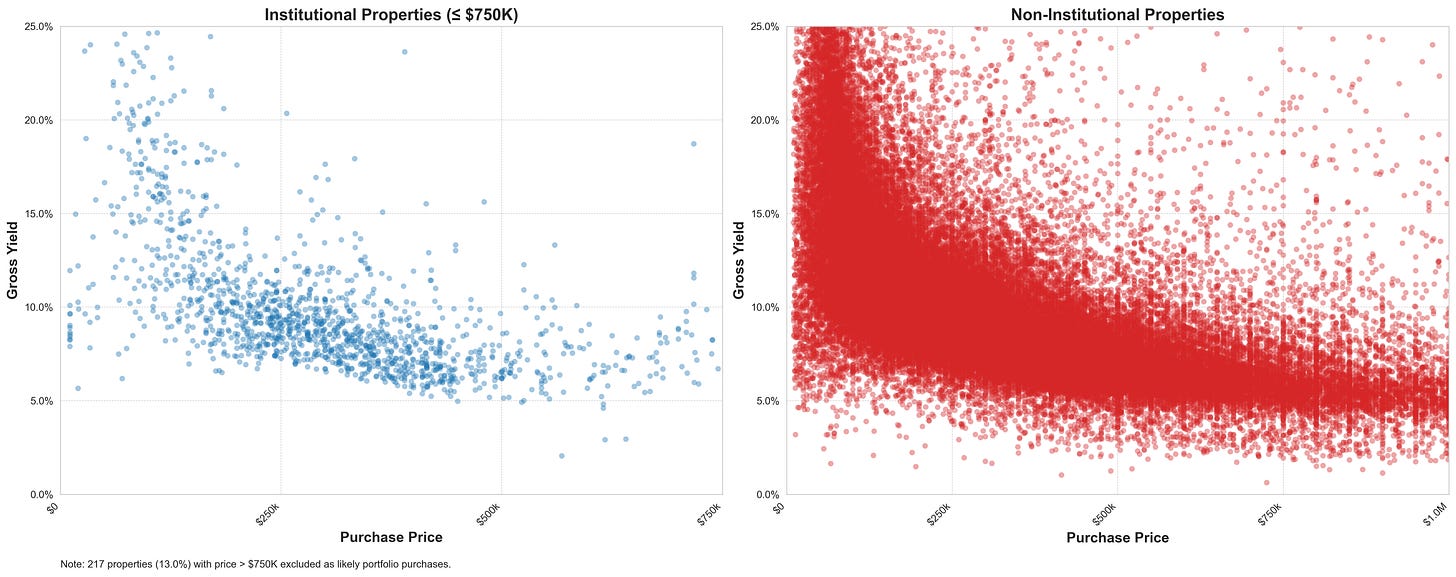

Nationwide distribution of gross yields vs purchase price.

Sale price vs gross yield for institutional purchases vs non-institutional purchases.

Our full analysis includes 20+ charts and in-depth commentary on the residential rental market.

Why Subscribe?

Join an elite group of industry leaders who rely on our in-depth analyses. Our paid subscribers include:

C-suite executives from major private lenders

Decision-makers at top SFR REIT operators

Analysts from leading equity research teams

Portfolio managers at leading hedge funds

Don't miss out on the insights driving decisions at the highest levels of the residential real estate industry.

Executive Summary

Analysis of 80,000+ rental properties purchased in 2024 reveals gross yields typically ranging from 8% to 15% annually

Core SFR markets like Phoenix, Dallas, and Atlanta dominated transaction volume

While institutional investors are primarily on the sidelines, both individuals and smaller operators are very active

Investor strategies are highly varied - buying everything from new construction at a 4% gross yield to properties in D-class neighborhoods at 30%+ gross yields

Subscribe Now for Instant Access