2023 SFR Rental Acquisitions Overview

Investor purchase activity, gross yields by geography, and more.

Executive Summary

Using data collected internally, we’ve identified 50,000+ rental properties purchased in 2023 with gross yields typically ranging from 7% to 10%

Gross yields vary significantly by geography, with cities like Cleveland, Baltimore, and Memphis offering yields of 15%+

The post explores gross yields across a variety of metros, difference in institutional vs non-institutional buy boxes, rental price distributions within metro areas, and heat maps of gross yields in major metros broken down by ZIP code

The second half of the post is available to paid subscribers, breaking down the activity and yields of institutional SFR funds compared to small-scale investors and individuals

As a bonus, paid subscribers are also able to download row-level data, including properties tagged to SFR funds

Data Overview

At SFR Analytics, we leverage nationwide deed, assessor, and rental listing data to track the single family rental market. To generate this analysis, we’ve:

Identified and reconciled the entities that SFR funds have purchased homes under

Matched rental listing data to the underlying ownership information that links an entity to an SFR fund

This post covers properties sold this year that were subsequently listed for rent (note: while we have broad coverage, some rental listings may not be captured, especially properties that aren’t listed for rent via a publicly accessible online portal)

Analysis & Results

We analyzed 50,000+ rental properties purchased this year to gauge the yields available to investors and how they vary by region.

Nationwide Gross Yields

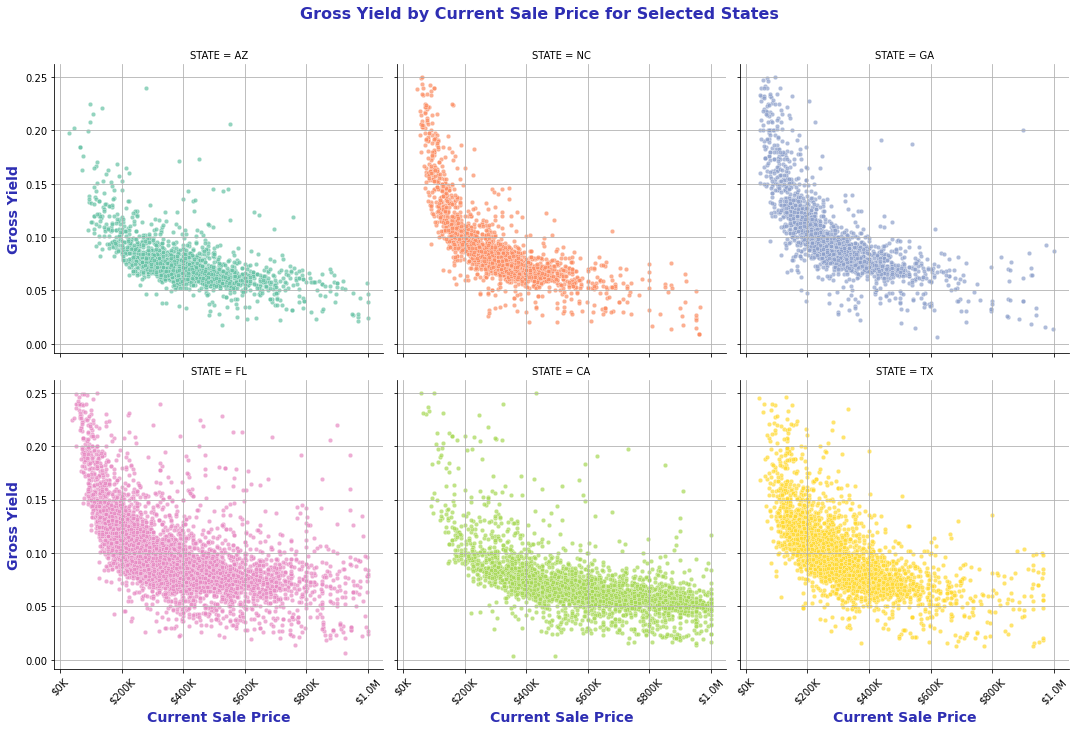

Nationwide, most rentals purchased this year have a gross yield between 7-10% annually. In general, homes purchased at a higher price tend to offer a lower gross yield (homes at the lower end of purchase price may have renovation costs involved, meaning that the net yield to an investor would be lower).

Across states, the relationship between purchase price and gross yields holds despite meaningful differences in purchase price. Of the states that have the most single family rental properties, North Carolina, Georgia, Florida, and Texas have the highest concentration of 10%+ gross yields while California and Arizona have significantly less.

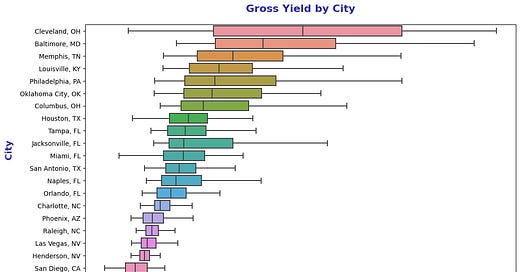

Gross Yield by City

Higher purchase price cities like San Diego have yields almost as low as 5%, while lower cost cities like Cleveland, Baltimore, and Memphis have offered yields of 15%+.

Rental Price Distribution

Intrastate rental price distributions can vary significantly. Looking at Florida, Jacksonville and Orlando behave very differently, with a $500+ difference between median rents. Other cities, like Miami, have a long-tail of high-priced rentals that don’t exist in other core metro areas.

Most Active Cities by Purchase Count

Cities like Las Vegas, Philadelphia, and Jacksonville topped the list for regions with the highest number of rental properties purchased in 2023.

SFR Fund Activity Profile & Market-Level Gross Yields

Digging in further, there are notable difference between the types of properties purchased by SFR funds compared with small-scale or individual investors along with the gross yields available.

At the end of the section, a link is available to get access to transaction-level data showing specific purchases made by institutional funds.

Note: the remainder of this article is available to paid subscribers, sign up below for access. Paid subscribers get full access to weekly data-rich articles about the SFR market and select additional articles only available to paid subscribers.